An innovative approach to risk

Traditionally, risk measures such as volatility have been used because of their simple mathematical properties. But that’s not how humans perceive risk. They think of it in terms of depth of loss (drawdown), frequency of losses, and time to recovery. Traditional risk measures also require an additional risk-model, and iVaR is inherently more robust to hidden risks.

An innovative approach to risk

Traditionally, risk measures such as volatility have been used because of their simple mathematical properties. But that’s not how humans perceive risk. They think of it in terms of depth of loss (drawdown), frequency of losses, and time to recovery. Traditional risk measures also require an additional risk-model, and iVaR is inherently more robust to hidden risks.

An innovative approach to risk

Traditionally, risk measures such as volatility have been used because of their simple mathematical properties. But that’s not how humans perceive risk. They think of it in terms of depth of loss (drawdown), frequency of losses, and time to recovery. Traditional risk measures also require an additional risk-model, and iVaR is inherently more robust to hidden risks.

An innovative approach to risk

Traditionally, risk measures such as volatility have been used because of their simple mathematical properties. But that’s not how humans perceive risk. They think of it in terms of depth of loss (drawdown), frequency of losses, and time to recovery. Traditional risk measures also require an additional risk-model, and iVaR is inherently more robust to hidden risks.

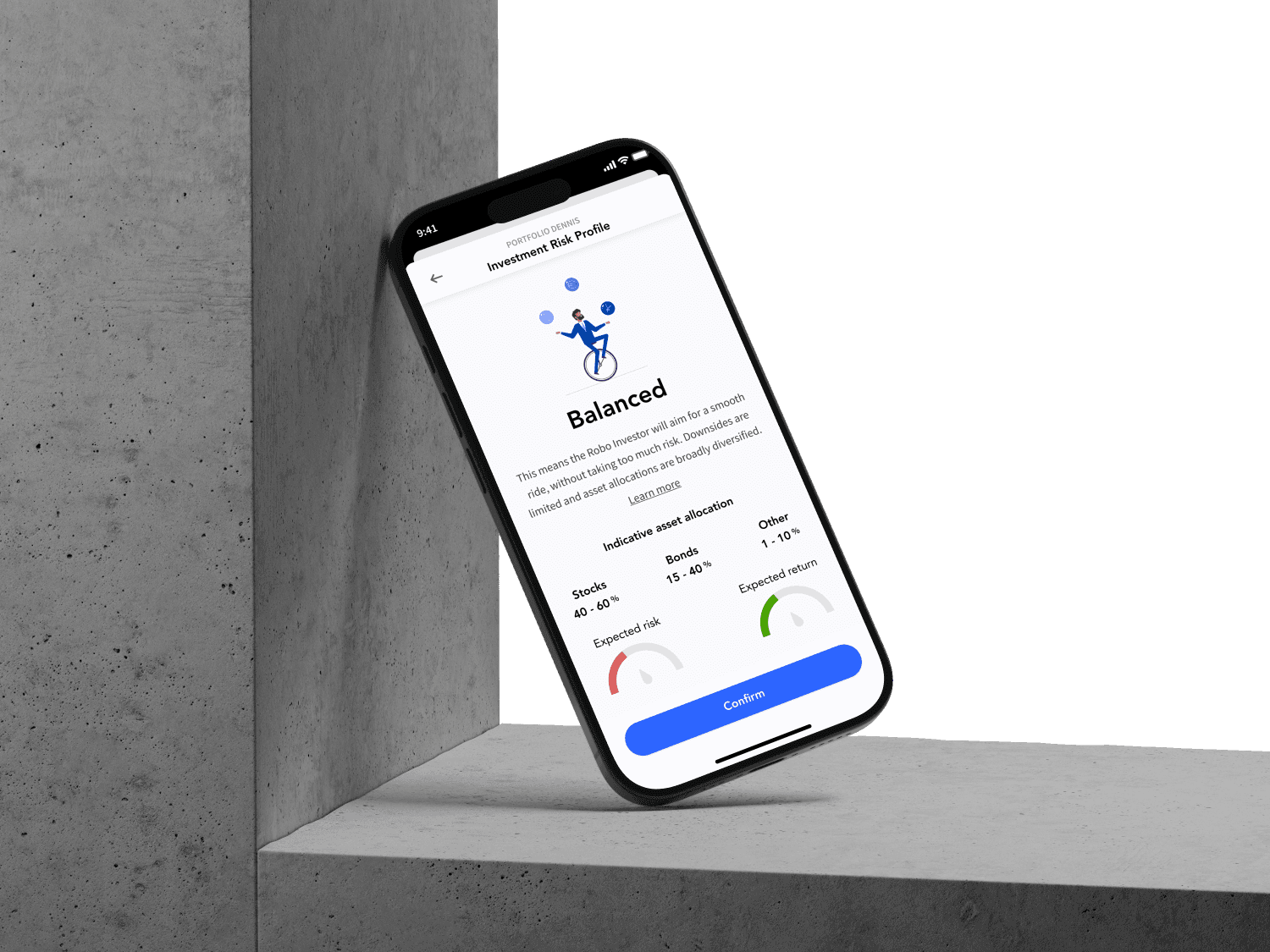

Portfolios you and your customers will enjoy.

When investors want to minimize the risk of their investment portfolio, this essentially means that they want to minimize the stress involved with investing. This stress is not a result of experiencing high volatility or high theoretical VaR or CVaR values in a portfolio, but rather simply a result of losing money.

Our iVaR portfolio construction framework aims to minimize this stress, which has important advantages for both investors and their portfolio managers/advisors.

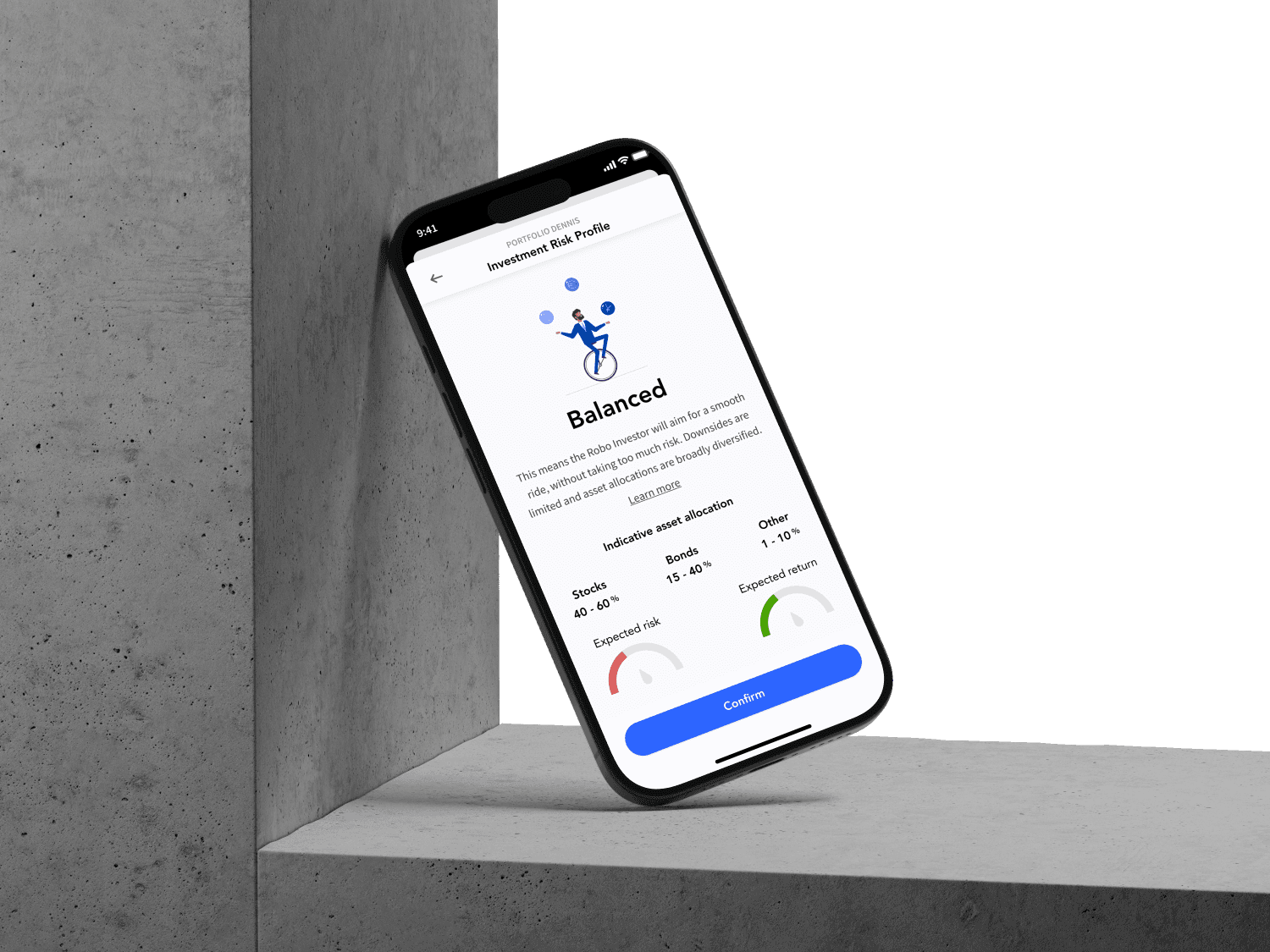

Portfolios you and your customers will enjoy.

When investors want to minimize the risk of their investment portfolio, this essentially means that they want to minimize the stress involved with investing. This stress is not a result of experiencing high volatility or high theoretical VaR or CVaR values in a portfolio, but rather simply a result of losing money.

Our iVaR portfolio construction framework aims to minimize this stress, which has important advantages for both investors and their portfolio managers/advisors.

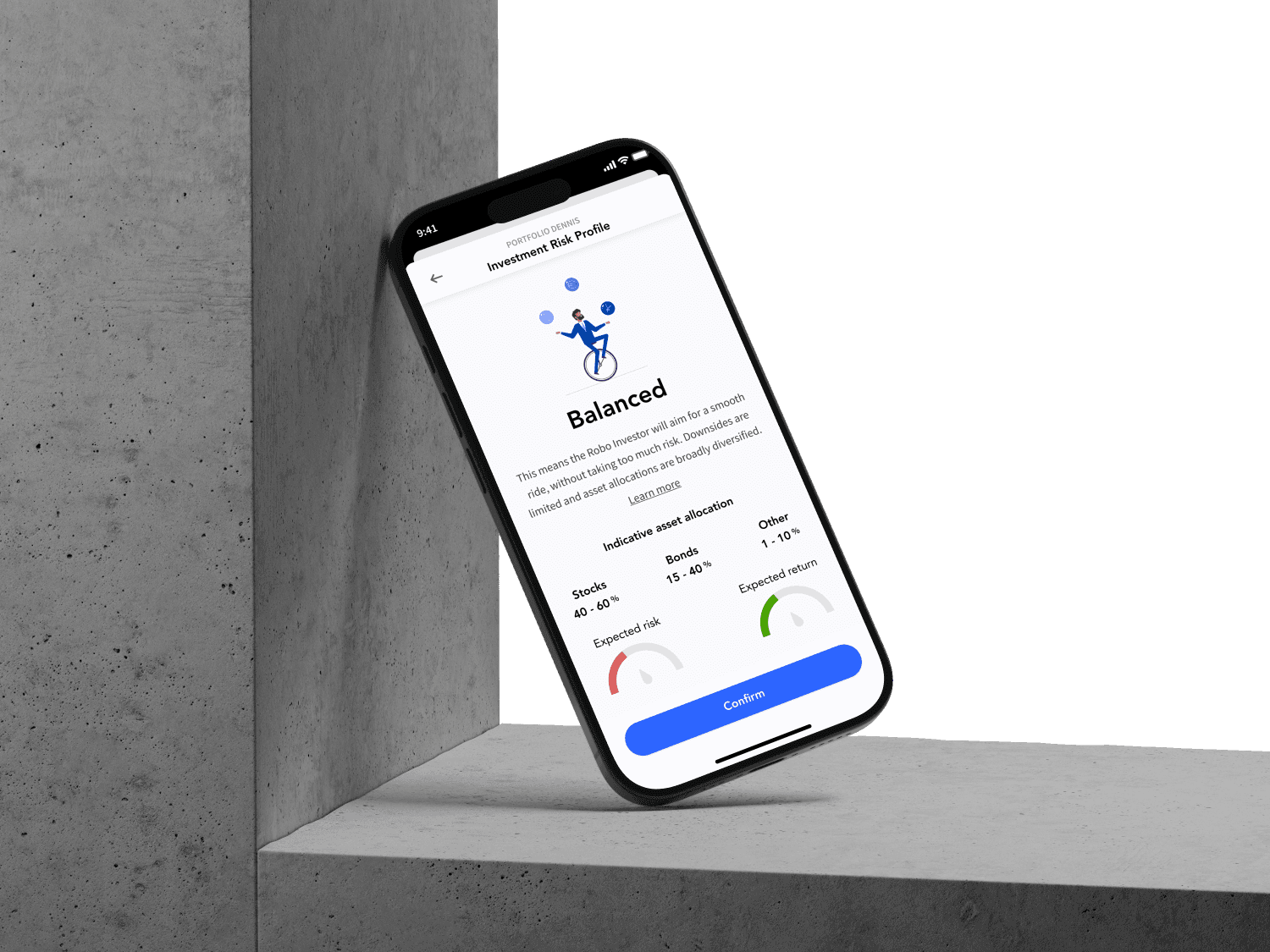

Portfolios you and your customers will enjoy.

When investors want to minimize the risk of their investment portfolio, this essentially means that they want to minimize the stress involved with investing. This stress is not a result of experiencing high volatility or high theoretical VaR or CVaR values in a portfolio, but rather simply a result of losing money.

Our iVaR portfolio construction framework aims to minimize this stress, which has important advantages for both investors and their portfolio managers/advisors.

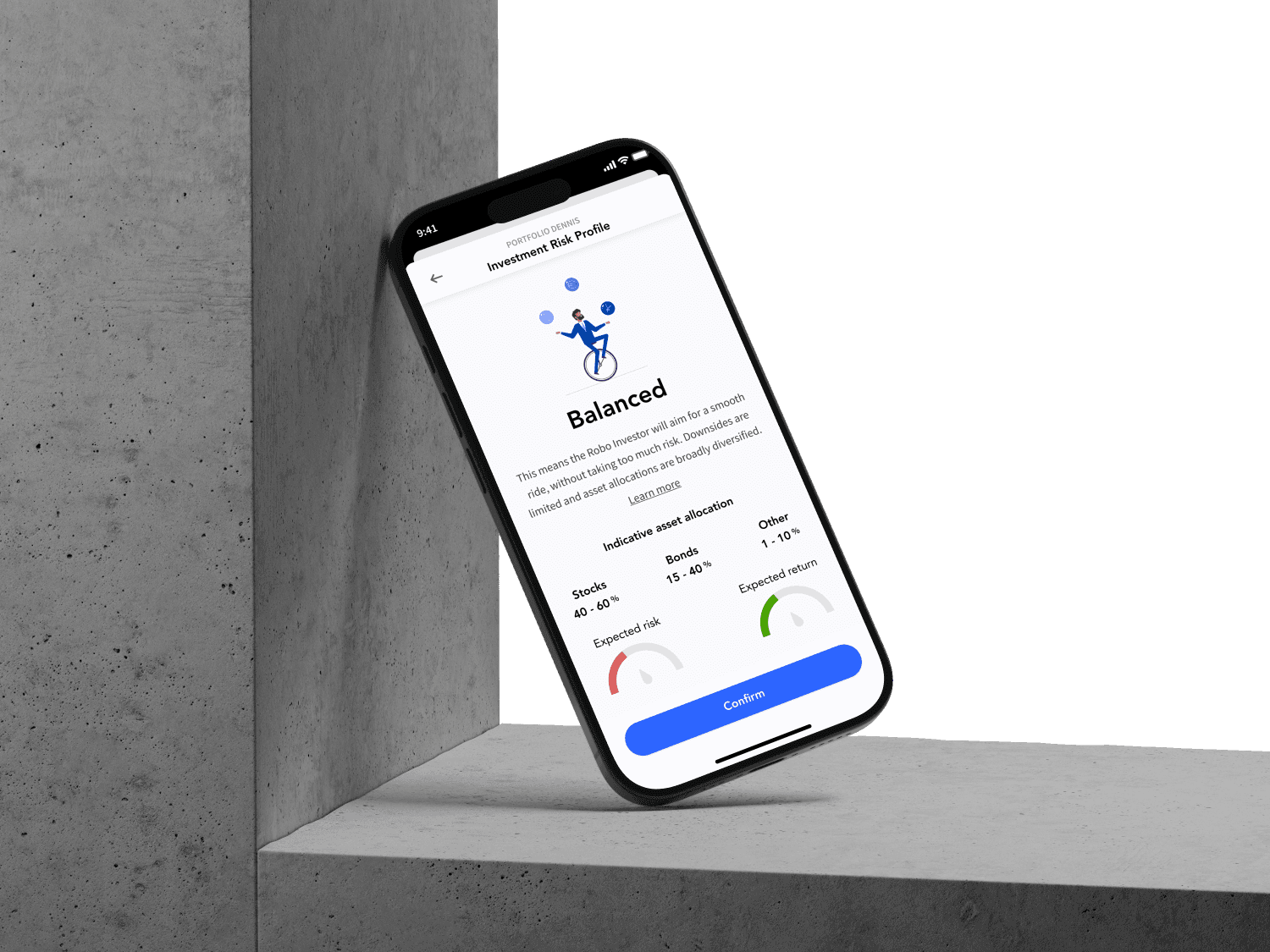

Portfolios you and your customers will enjoy.

When investors want to minimize the risk of their investment portfolio, this essentially means that they want to minimize the stress involved with investing. This stress is not a result of experiencing high volatility or high theoretical VaR or CVaR values in a portfolio, but rather simply a result of losing money.

Our iVaR portfolio construction framework aims to minimize this stress, which has important advantages for both investors and their portfolio managers/advisors.

The Principle

We calculate the risk ("iVaR") as the deviation from monotonic growth. It is the sum of all of the light pink areas in the chart, which combines the frequency, depth, and the time (width) needed to make up for the losses.

The objective

The objective of our portfolio construction framework is to minimize the frequency, the magnitude and the duration of drawdowns; in other words, the goal is to minimize the iVaR value.

The Effects

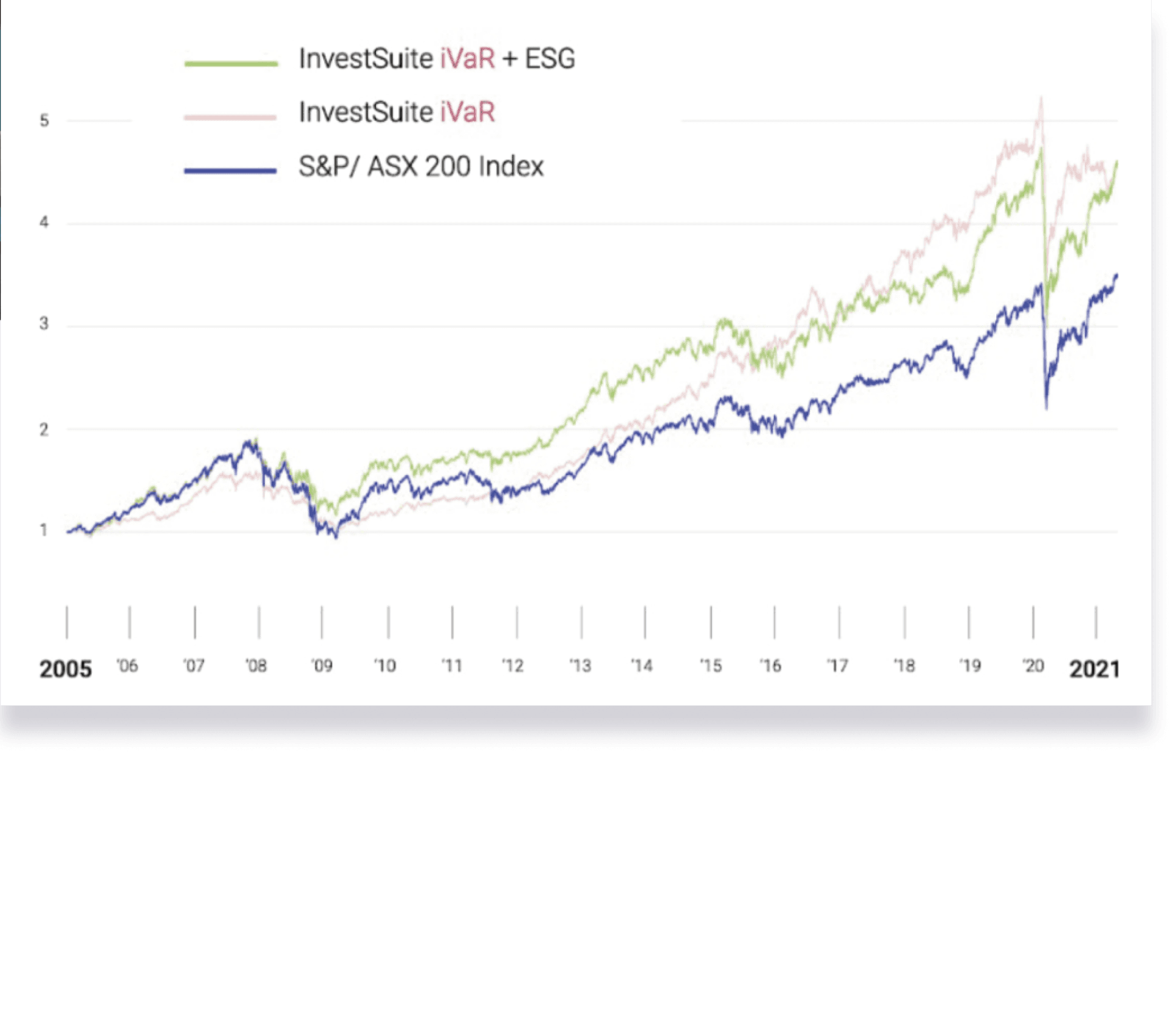

This 4th generation risk-measure can also be used to define relative risk versus a benchmark or index, similar to how volatility can be used to define relative risk via tracking error. Using this risk measure in portfolio construction should lead to portfolios that suffer lower losses (versus a benchmark) and make up those losses more quickly, compared to traditional risk measures.

Our iVaR white paper

Over time, iVaR should enable a smoother ride for investor’s portfolio when compared to traditional risk measures and portfolio construction methodologies.

The Principle

We calculate the risk ("iVaR") as the deviation from monotonic growth. It is the sum of all of the light pink areas in the chart, which combines the frequency, depth, and the time (width) needed to make up for the losses.

The objective

The objective of our portfolio construction framework is to minimize the frequency, the magnitude and the duration of drawdowns; in other words, the goal is to minimize the iVaR value.

The Effects

This 4th generation risk-measure can also be used to define relative risk versus a benchmark or index, similar to how volatility can be used to define relative risk via tracking error. Using this risk measure in portfolio construction should lead to portfolios that suffer lower losses (versus a benchmark) and make up those losses more quickly, compared to traditional risk measures.

Our iVaR white paper

Over time, iVaR should enable a smoother ride for investor’s portfolio when compared to traditional risk measures and portfolio construction methodologies.

The Principle

We calculate the risk ("iVaR") as the deviation from monotonic growth. It is the sum of all of the light pink areas in the chart, which combines the frequency, depth, and the time (width) needed to make up for the losses.

The objective

The objective of our portfolio construction framework is to minimize the frequency, the magnitude and the duration of drawdowns; in other words, the goal is to minimize the iVaR value.

The Effects

This 4th generation risk-measure can also be used to define relative risk versus a benchmark or index, similar to how volatility can be used to define relative risk via tracking error. Using this risk measure in portfolio construction should lead to portfolios that suffer lower losses (versus a benchmark) and make up those losses more quickly, compared to traditional risk measures.

Our iVaR white paper

Over time, iVaR should enable a smoother ride for investor’s portfolio when compared to traditional risk measures and portfolio construction methodologies.

The Principle

We calculate the risk ("iVaR") as the deviation from monotonic growth. It is the sum of all of the light pink areas in the chart, which combines the frequency, depth, and the time (width) needed to make up for the losses.

The objective

The objective of our portfolio construction framework is to minimize the frequency, the magnitude and the duration of drawdowns; in other words, the goal is to minimize the iVaR value.

The Effects

This 4th generation risk-measure can also be used to define relative risk versus a benchmark or index, similar to how volatility can be used to define relative risk via tracking error. Using this risk measure in portfolio construction should lead to portfolios that suffer lower losses (versus a benchmark) and make up those losses more quickly, compared to traditional risk measures.

Our iVaR white paper

Over time, iVaR should enable a smoother ride for investor’s portfolio when compared to traditional risk measures and portfolio construction methodologies.

Questions

We created a FAQ with frequently asked questions on iVaR.

Questions

We created a FAQ with frequently asked questions on iVaR.

Questions

We created a FAQ with frequently asked questions on iVaR.

digital investing and reporting

Diversification in an iVaR framework: How iVaR leapfrogs Markowitz’ Curse of Diversification.

In this paper, we will explore how iVaR provides a next-generation, human-centric measure of risk that captures all risk dimensions an investor might care about. Building further on Dr. Markowitz groundbreaking work, we compare iVaR to traditional variance-based portfolios and find that iVaR tends to concentrate less and leads to more natural diversification. Dr. Markowitz was a pioneer in the world of economics and finance. His contributions and influence will remain a guiding force for us.

Read more

Assessing the subjective dimensions of risk tolerance

The limited space and time available during the in-app onboarding of clients creates a real challenge for roboadvisors. Collecting objective facts about investors is one thing. Understanding how they feel about risk is something completely different. It requires a scientifically sound methodology combined with an engaging user experience that sets the tone for a long and fruitful relationship.

Read more

Embracing the human perception of risk

InvestSuite’s approach to measuring risk arose from the desire to capture what people intuitively perceive as investment risk. In the end, investors all want the same thing – an account that offers the steady growth of a savings account with a very low probability of losing money, but with the returns of the stock market. We cannot guarantee this, but we can optimise for it, which is precisely why we have developed our own measure of risk: iVaR.

Read more

Diversification in an iVaR framework: How iVaR leapfrogs Markowitz’ Curse of Diversification.

In this paper, we will explore how iVaR provides a next-generation, human-centric measure of risk that captures all risk dimensions an investor might care about. Building further on Dr. Markowitz groundbreaking work, we compare iVaR to traditional variance-based portfolios and find that iVaR tends to concentrate less and leads to more natural diversification. Dr. Markowitz was a pioneer in the world of economics and finance. His contributions and influence will remain a guiding force for us.

Read more

Assessing the subjective dimensions of risk tolerance

The limited space and time available during the in-app onboarding of clients creates a real challenge for roboadvisors. Collecting objective facts about investors is one thing. Understanding how they feel about risk is something completely different. It requires a scientifically sound methodology combined with an engaging user experience that sets the tone for a long and fruitful relationship.

Read more

Embracing the human perception of risk

InvestSuite’s approach to measuring risk arose from the desire to capture what people intuitively perceive as investment risk. In the end, investors all want the same thing – an account that offers the steady growth of a savings account with a very low probability of losing money, but with the returns of the stock market. We cannot guarantee this, but we can optimise for it, which is precisely why we have developed our own measure of risk: iVaR.

Read more

digital investing and reporting

Diversification in an iVaR framework: How iVaR leapfrogs Markowitz’ Curse of Diversification.

In this paper, we will explore how iVaR provides a next-generation, human-centric measure of risk that captures all risk dimensions an investor might care about. Building further on Dr. Markowitz groundbreaking work, we compare iVaR to traditional variance-based portfolios and find that iVaR tends to concentrate less and leads to more natural diversification. Dr. Markowitz was a pioneer in the world of economics and finance. His contributions and influence will remain a guiding force for us.

Read more

Assessing the subjective dimensions of risk tolerance

The limited space and time available during the in-app onboarding of clients creates a real challenge for roboadvisors. Collecting objective facts about investors is one thing. Understanding how they feel about risk is something completely different. It requires a scientifically sound methodology combined with an engaging user experience that sets the tone for a long and fruitful relationship.

Read more

Embracing the human perception of risk

InvestSuite’s approach to measuring risk arose from the desire to capture what people intuitively perceive as investment risk. In the end, investors all want the same thing – an account that offers the steady growth of a savings account with a very low probability of losing money, but with the returns of the stock market. We cannot guarantee this, but we can optimise for it, which is precisely why we have developed our own measure of risk: iVaR.