Portfolio construction for the digital age

A portfolio construction framework that allows cost-effective customization at scale.

Portfolio construction for the digital age

A portfolio construction framework that allows cost-effective customization at scale.

Portfolio construction for the digital age

A portfolio construction framework that allows cost-effective customization at scale.

Portfolio construction for the digital age

A portfolio construction framework that allows cost-effective customization at scale.

There’s no perfect portfolio, only a right portfolio for a specific individual.

Implement true customer intimacy

Customers need to be invested in portfolios they feel comfortable with. That includes portfolios that align with their values and goals.

Forget about 'one-size-fits-all'

Because it fits none. Say goodbye to generalized solutions, and offer personalized investment experiences that truly resonate with your clients.

Build portfolios effortlessly

Construct thousands of individualized portfolios with ease in just a few seconds.

There’s no perfect portfolio, only a right portfolio for a specific individual.

Implement true customer intimacy

Customers need to be invested in portfolios they feel comfortable with. That includes portfolios that align with their values and goals.

Forget about 'one-size-fits-all'

Because it fits none. Say goodbye to generalized solutions, and offer personalized investment experiences that truly resonate with your clients.

Build portfolios effortlessly

Construct thousands of individualized portfolios with ease in just a few seconds.

There’s no perfect portfolio, only a right portfolio for a specific individual.

Implement true customer intimacy

Customers need to be invested in portfolios they feel comfortable with. That includes portfolios that align with their values and goals.

Forget about 'one-size-fits-all'

Because it fits none. Say goodbye to generalized solutions, and offer personalized investment experiences that truly resonate with your clients.

Build portfolios effortlessly

Construct thousands of individualized portfolios with ease in just a few seconds.

There’s no perfect portfolio, only a right portfolio for a specific individual.

Implement true customer intimacy

Customers need to be invested in portfolios they feel comfortable with. That includes portfolios that align with their values and goals.

Forget about 'one-size-fits-all'

Because it fits none. Say goodbye to generalized solutions, and offer personalized investment experiences that truly resonate with your clients.

Build portfolios effortlessly

Construct thousands of individualized portfolios with ease in just a few seconds.

Access our next-generation risk framework

iVaR understands risks like humans do, so you can offer portfolios that better take into account cognitive biases. We also support traditional risk measures such as volatility, VaR, and cVaR if you prefer those.

Rapid setup & infinitely scalable

Integrate our web based platform or REST API. The setup is scalable thanks to our serverless architecture in the cloud and supports a large number of optimisations running in parallel. Leverage our tools and expertise to get to market with new value propositions quickly.

Allow for hyper-personalisation

Explicit views and thematic investing are key to portfolio customisation. Market views can be incorporated via allocation and other limits, or the explicit input of expected returns. Hyper-personalisation of the portfolios is possible via a range of objectives such as expected return, risk, ESG tilts, fundamental factor tilts, tax liability, etc.

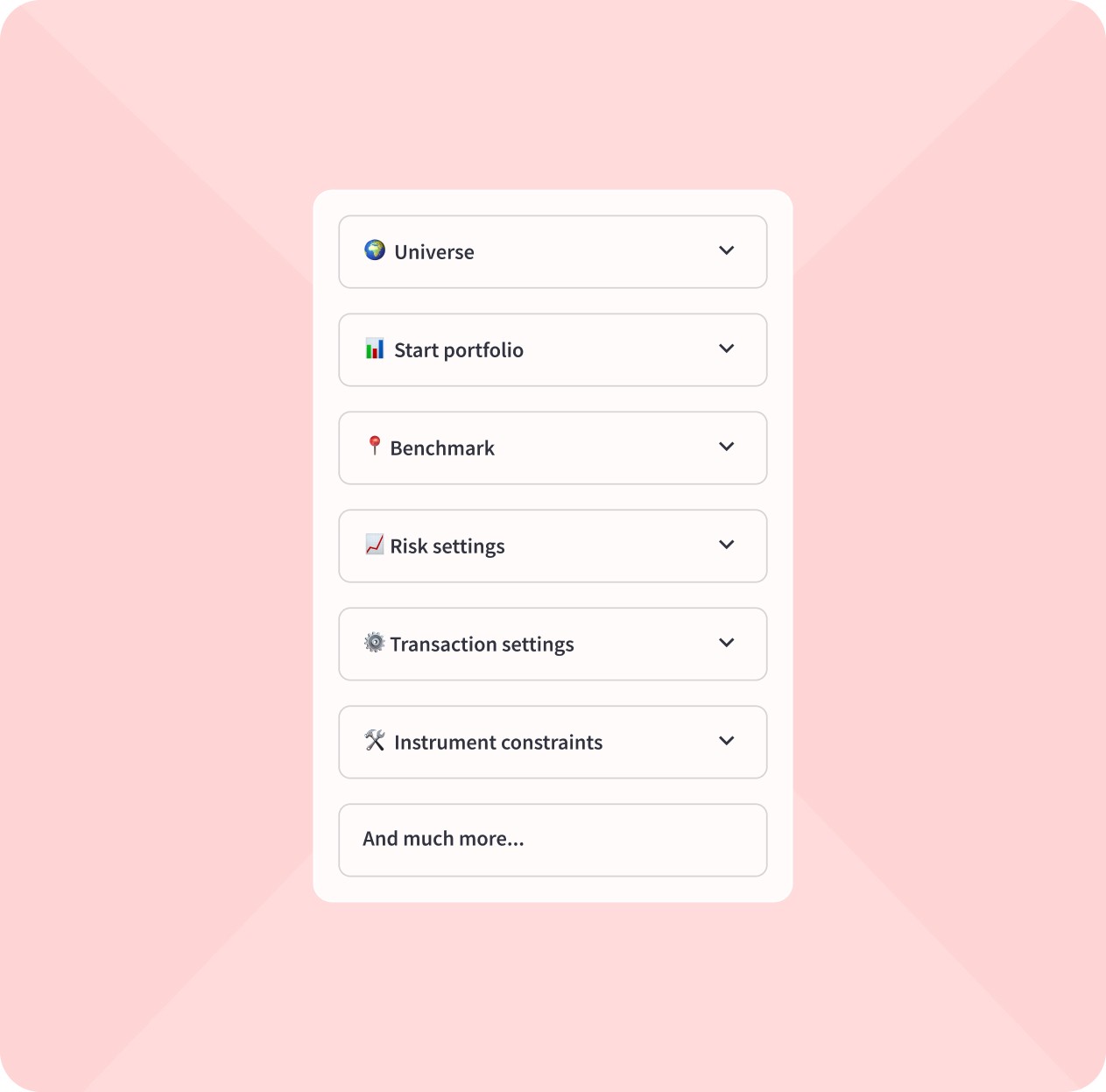

Access the broadest investment universe

The universe can consist of ETFs, stocks, crypto assets, (OTC) mutual funds, Sukuks, and others.

🌍 Universe

Select the universe of investable

instruments

EU STOCKS

ISINs to exclude from the universe:

Choose an option

Access our next-generation risk framework

iVaR understands risks like humans do, so you can offer portfolios that better take into account cognitive biases. We also support traditional risk measures such as volatility, VaR, and cVaR if you prefer those.

Rapid setup & infinitely scalable

Integrate our web based platform or REST API. The setup is scalable thanks to our serverless architecture in the cloud and supports a large number of optimisations running in parallel. Leverage our tools and expertise to get to market with new value propositions quickly.

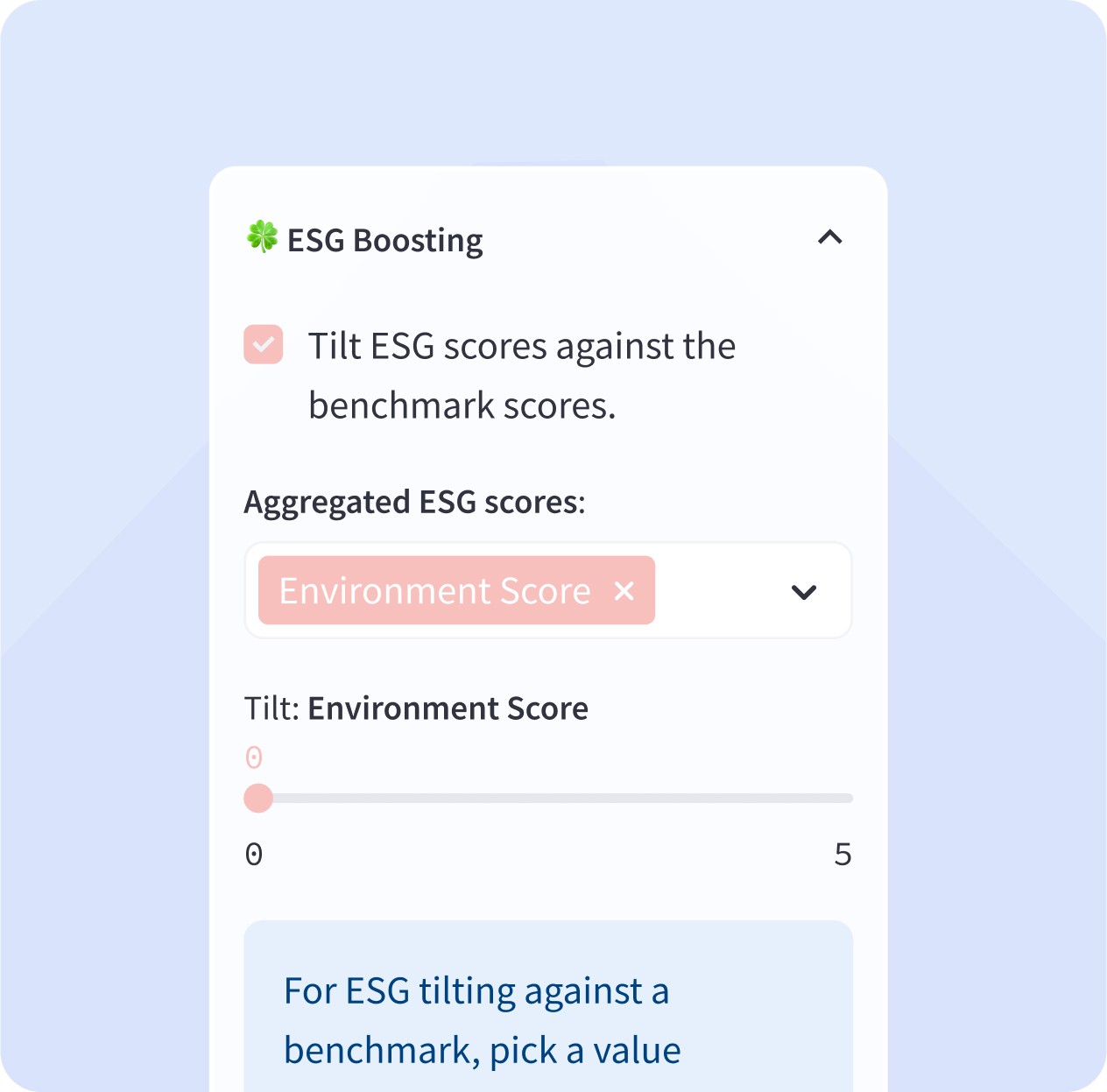

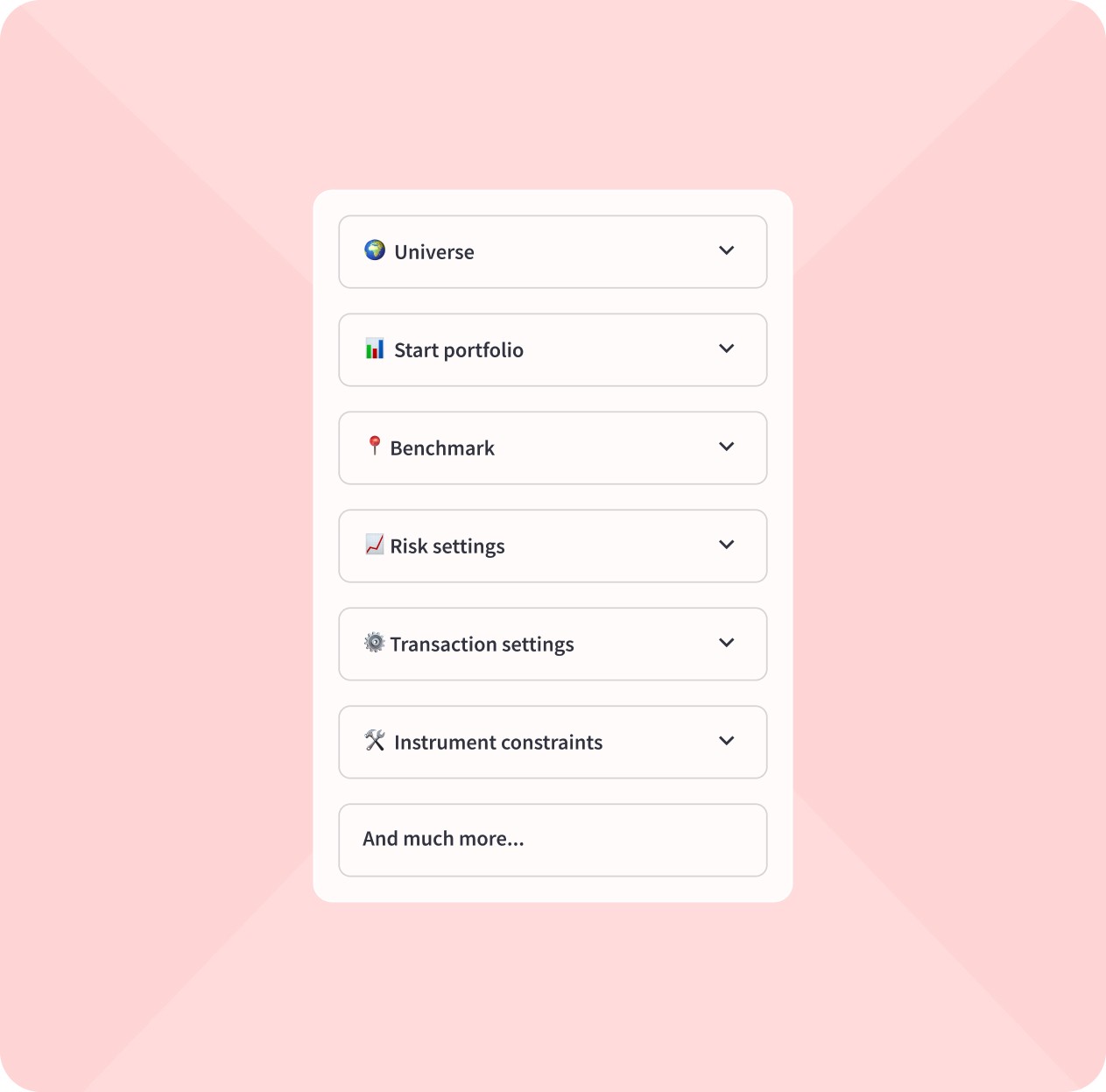

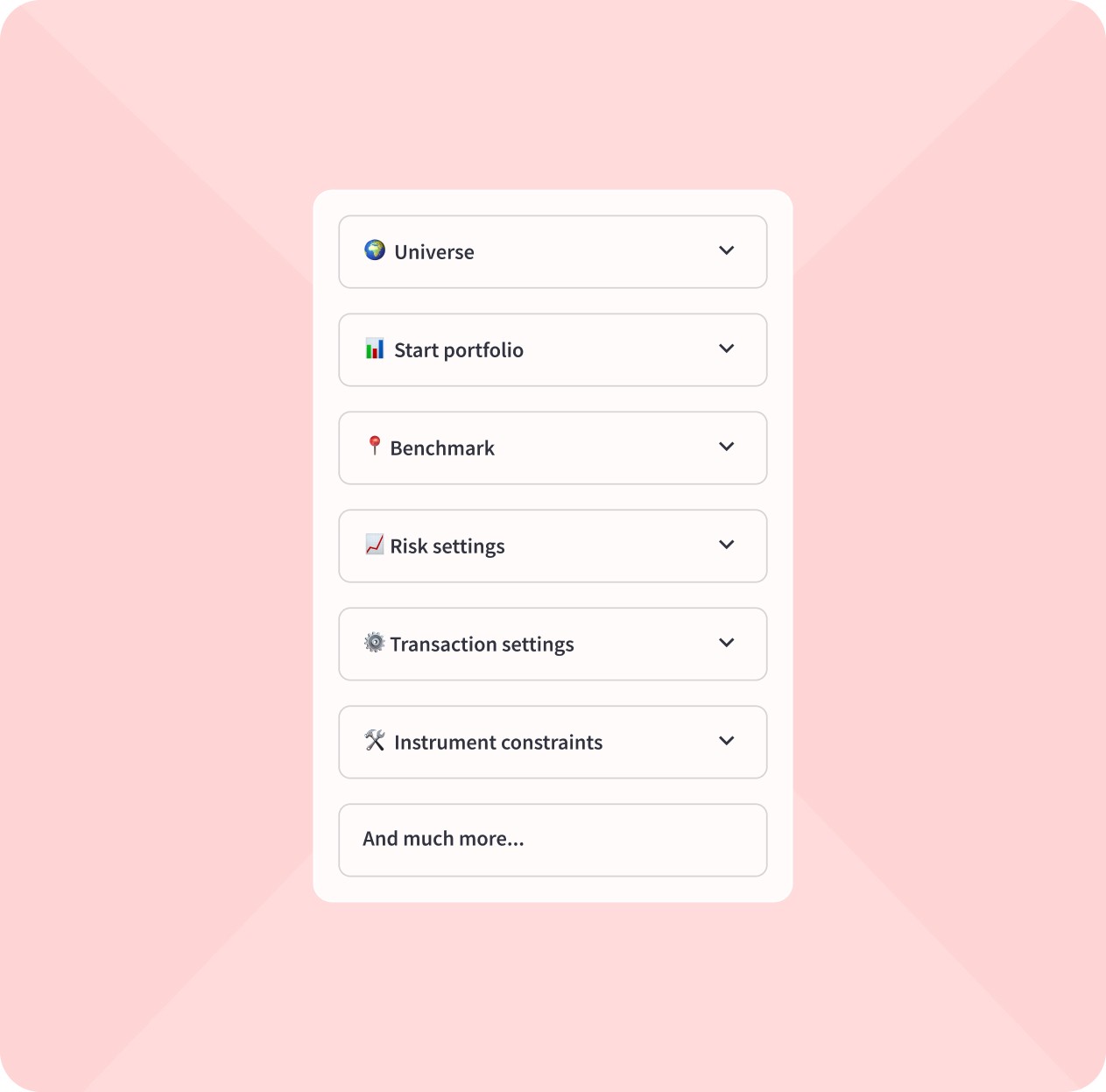

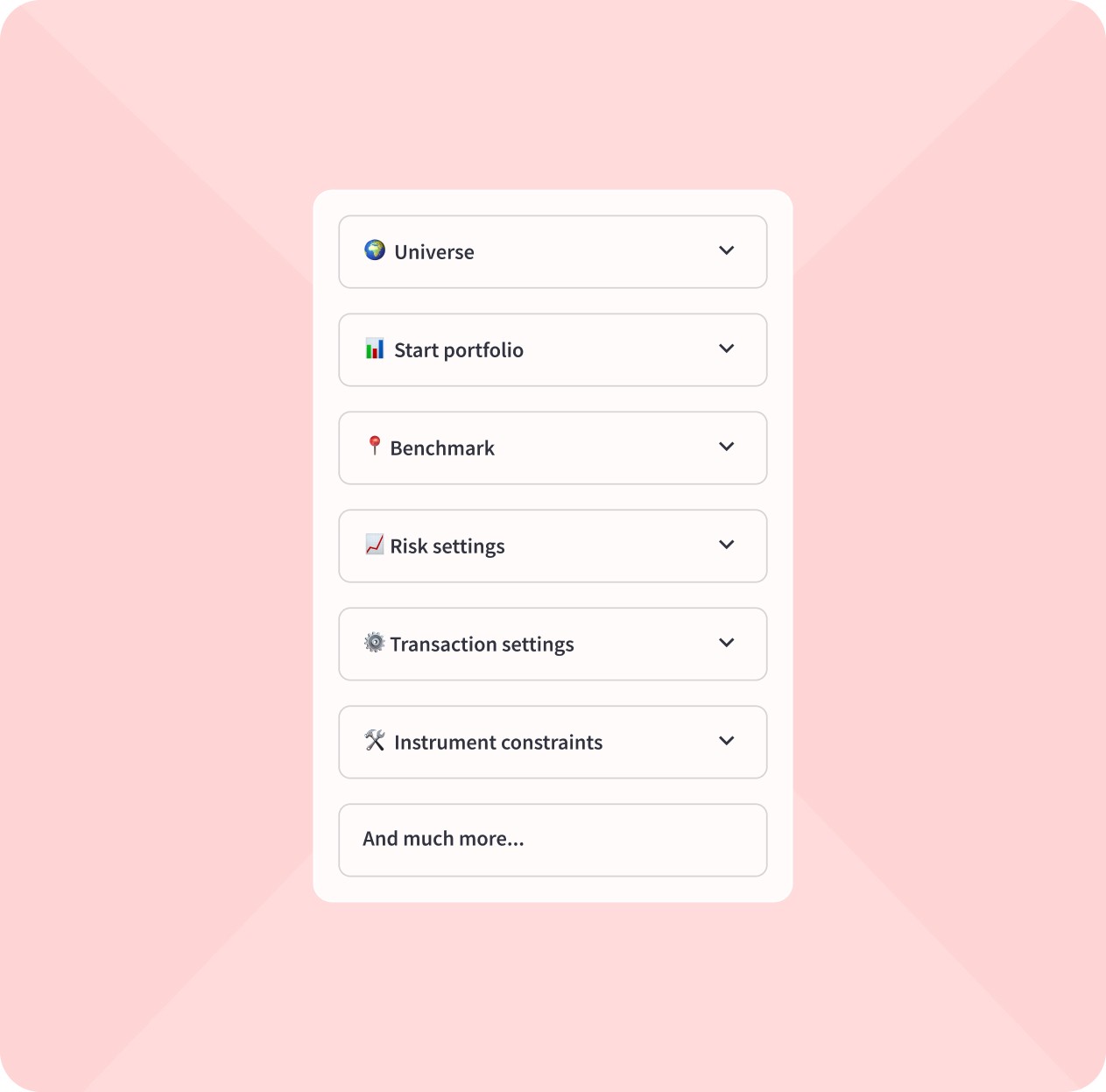

Allow for hyper-personalisation

Explicit views and thematic investing are key to portfolio customisation. Market views can be incorporated via allocation and other limits, or the explicit input of expected returns. Hyper-personalisation of the portfolios is possible via a range of objectives such as expected return, risk, ESG tilts, fundamental factor tilts, tax liability, etc.

Access the broadest investment universe

The universe can consist of ETFs, stocks, crypto assets, (OTC) mutual funds, Sukuks, and others.

🌍 Universe

Select the universe of investable

instruments

EU STOCKS

ISINs to exclude from the universe:

Choose an option

Access our next-generation risk framework

iVaR understands risks like humans do, so you can offer portfolios that better take into account cognitive biases. We also support traditional risk measures such as volatility, VaR, and cVaR if you prefer those.

Rapid setup & infinitely scalable

Integrate our web based platform or REST API. The setup is scalable thanks to our serverless architecture in the cloud and supports a large number of optimisations running in parallel. Leverage our tools and expertise to get to market with new value propositions quickly.

Allow for hyper-personalisation

Explicit views and thematic investing are key to portfolio customisation. Market views can be incorporated via allocation and other limits, or the explicit input of expected returns. Hyper-personalisation of the portfolios is possible via a range of objectives such as expected return, risk, ESG tilts, fundamental factor tilts, tax liability, etc.

Access the broadest investment universe

The universe can consist of ETFs, stocks, crypto assets, (OTC) mutual funds, Sukuks, and others.

🌍 Universe

Select the universe of investable

instruments

EU STOCKS

ISINs to exclude from the universe:

Choose an option

Access our next-generation risk framework

iVaR understands risks like humans do, so you can offer portfolios that better take into account cognitive biases. We also support traditional risk measures such as volatility, VaR, and cVaR if you prefer those.

Rapid setup & infinitely scalable

Integrate our web based platform or REST API. The setup is scalable thanks to our serverless architecture in the cloud and supports a large number of optimisations running in parallel. Leverage our tools and expertise to get to market with new value propositions quickly.

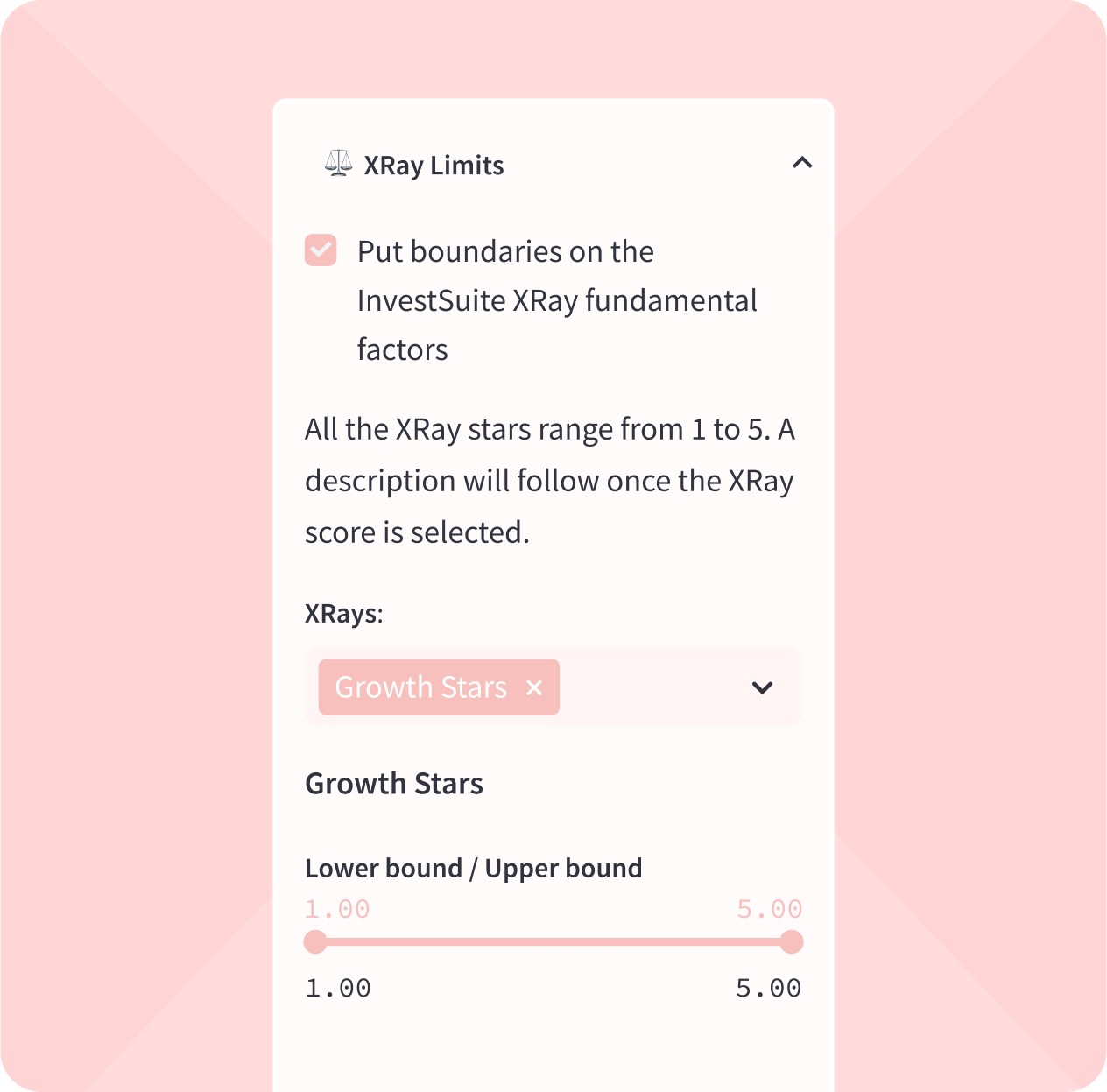

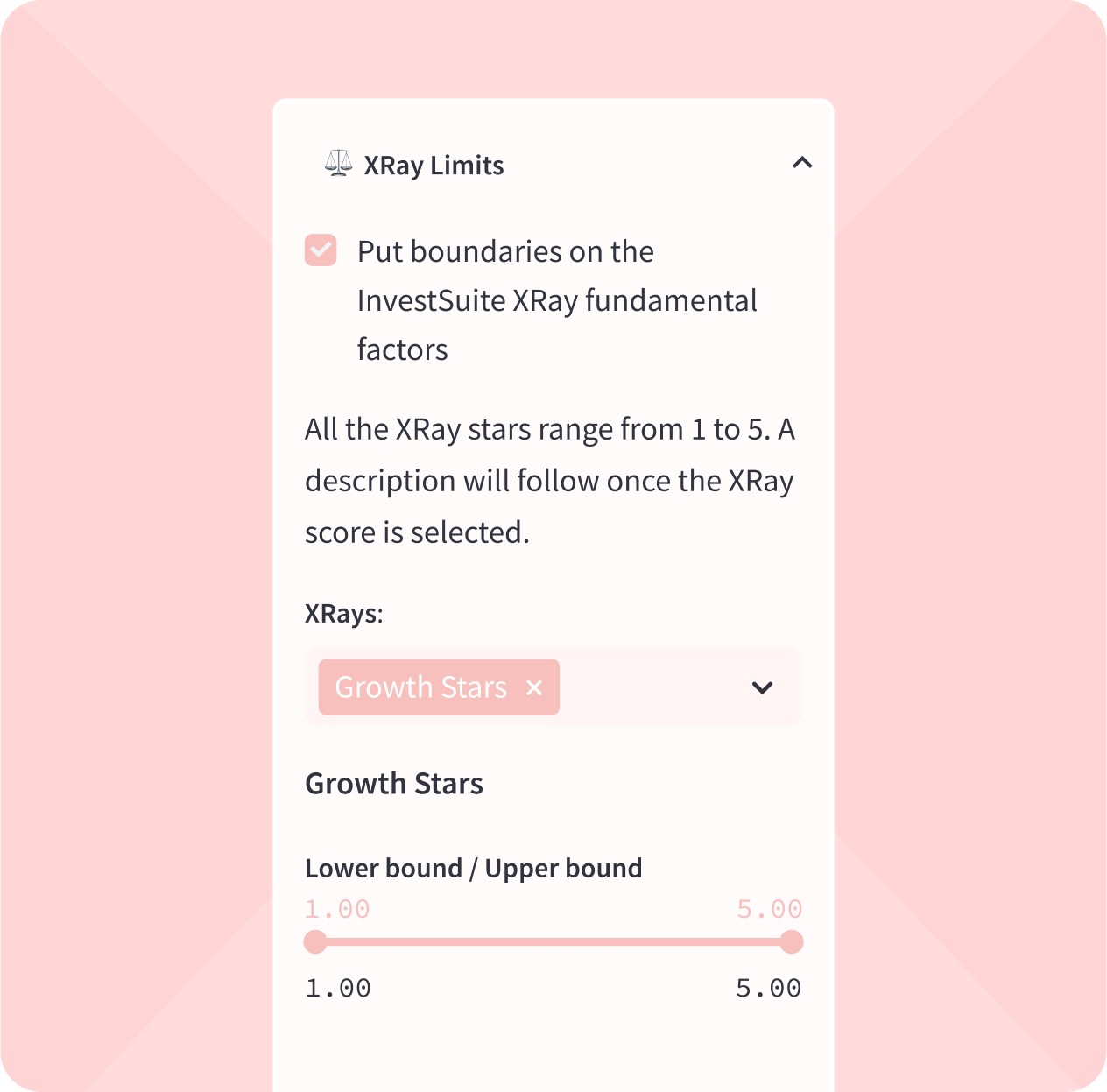

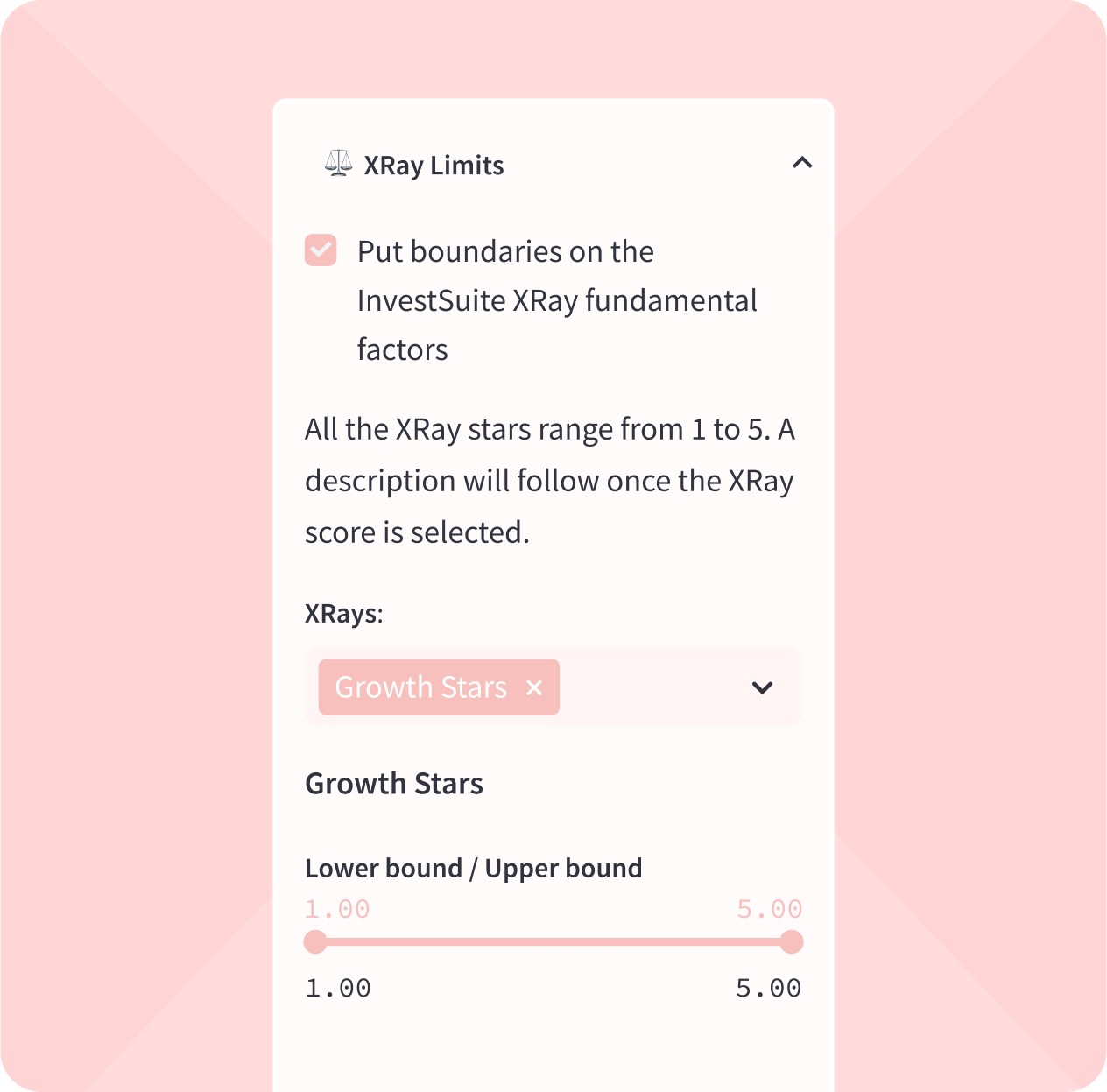

Allow for hyper-personalisation

Explicit views and thematic investing are key to portfolio customisation. Market views can be incorporated via allocation and other limits, or the explicit input of expected returns. Hyper-personalisation of the portfolios is possible via a range of objectives such as expected return, risk, ESG tilts, fundamental factor tilts, tax liability, etc.

Access the broadest investment universe

The universe can consist of ETFs, stocks, crypto assets, (OTC) mutual funds, Sukuks, and others.

🌍 Universe

Select the universe of investable

instruments

EU STOCKS

ISINs to exclude from the universe:

Choose an option

Hyper-personalized portfolios

Customers need to be invested in portfolios they feel comfortable with.

An optimal portfolio takes into account risk appetite and other constraints: ESG preferences, time horizon, asset classes preferences, etc.

Portfolio Optimizer offers a range of tools to tailor portfolios to the investors’ preference, so they stay with you forever.

Hyper-personalized portfolios

Customers need to be invested in portfolios they feel comfortable with.

An optimal portfolio takes into account risk appetite and other constraints: ESG preferences, time horizon, asset classes preferences, etc.

Portfolio Optimizer offers a range of tools to tailor portfolios to the investors’ preference, so they stay with you forever.

Hyper-personalized portfolios

Customers need to be invested in portfolios they feel comfortable with.

An optimal portfolio takes into account risk appetite and other constraints: ESG preferences, time horizon, asset classes preferences, etc.

Portfolio Optimizer offers a range of tools to tailor portfolios to the investors’ preference, so they stay with you forever.

Hyper-personalized portfolios

Customers need to be invested in portfolios they feel comfortable with.

An optimal portfolio takes into account risk appetite and other constraints: ESG preferences, time horizon, asset classes preferences, etc.

Portfolio Optimizer offers a range of tools to tailor portfolios to the investors’ preference, so they stay with you forever.

Offer digital assets with iVaR.

Portfolio Optimizer's iVaR has been used to build crypto portfolios since 2019 and offers a unique take on this new asset class. iVaR is ideal for crypto because traditional risk measures don’t work well there, as they assume a normal distribution of risk and don’t take into account the time it takes to make up for temporary losses.

Offer digital assets with iVaR.

Portfolio Optimizer's iVaR has been used to build crypto portfolios since 2019 and offers a unique take on this new asset class. iVaR is ideal for crypto because traditional risk measures don’t work well there, as they assume a normal distribution of risk and don’t take into account the time it takes to make up for temporary losses.

Offer digital assets with iVaR.

Portfolio Optimizer's iVaR has been used to build crypto portfolios since 2019 and offers a unique take on this new asset class. iVaR is ideal for crypto because traditional risk measures don’t work well there, as they assume a normal distribution of risk and don’t take into account the time it takes to make up for temporary losses.

Offer digital assets with iVaR.

Portfolio Optimizer's iVaR has been used to build crypto portfolios since 2019 and offers a unique take on this new asset class. iVaR is ideal for crypto because traditional risk measures don’t work well there, as they assume a normal distribution of risk and don’t take into account the time it takes to make up for temporary losses.

Mix & Match to suit your desired use case

Our APIs can be combined in any number of ways to build your optimal solution.

Flexible Portfolio Construction

Combine our tools like Lego blocks to create the exact portfolio you need, with customizable options such as portfolio construction APIs, iVaR, and custom risk models.

Maximum Freedom

Offer individual or model portfolios for direct indexing or to track customized indexes. Gain actionable insights with X-Ray API, scoring stocks on key dimensions like valuation and growth. And leverage our tools to get explicit and individualised downside protection.

Seamless Integration

Access our solutions through APIs for system integration or use the web-based console for portfolio management and back-office teams.

Mix & Match to suit your desired use case

Our APIs can be combined in any number of ways to build your optimal solution.

Flexible Portfolio Construction

Combine our tools like Lego blocks to create the exact portfolio you need, with customizable options such as portfolio construction APIs, iVaR, and custom risk models.

Maximum Freedom

Offer individual or model portfolios for direct indexing or to track customized indexes. Gain actionable insights with X-Ray API, scoring stocks on key dimensions like valuation and growth. And leverage our tools to get explicit and individualised downside protection.

Seamless Integration

Access our solutions through APIs for system integration or use the web-based console for portfolio management and back-office teams.

Mix & Match to suit your desired use case

Our APIs can be combined in any number of ways to build your optimal solution.

Flexible Portfolio Construction

Combine our tools like Lego blocks to create the exact portfolio you need, with customizable options such as portfolio construction APIs, iVaR, and custom risk models.

Maximum Freedom

Offer individual or model portfolios for direct indexing or to track customized indexes. Gain actionable insights with X-Ray API, scoring stocks on key dimensions like valuation and growth. And leverage our tools to get explicit and individualised downside protection.

Seamless Integration

Access our solutions through APIs for system integration or use the web-based console for portfolio management and back-office teams.

digital investing and reporting

Crypto portfolios beyond indexing and traditional risk measures

Building a portfolio of digital assets can be a complicated task because it’s quite new and different from traditional asset classes. But one thing is certain: approaching digital assets like traditional asset classes is a mistake. So, what’s the secret? We developed a way to intelligently build portfolios of digital assets. And we’ve put it to the test. It works in backtests and it also works in the market. Read the paper to learn more.

Read more

Diversification in an iVaR framework: How iVaR leapfrogs Markowitz’ Curse of Diversification.

In this paper, we will explore how iVaR provides a next-generation, human-centric measure of risk that captures all risk dimensions an investor might care about. Building further on Dr. Markowitz groundbreaking work, we compare iVaR to traditional variance-based portfolios and find that iVaR tends to concentrate less and leads to more natural diversification. Dr. Markowitz was a pioneer in the world of economics and finance. His contributions and influence will remain a guiding force for us.

Read more

Embracing the human perception of risk

InvestSuite’s approach to measuring risk arose from the desire to capture what people intuitively perceive as investment risk. In the end, investors all want the same thing – an account that offers the steady growth of a savings account with a very low probability of losing money, but with the returns of the stock market. We cannot guarantee this, but we can optimise for it, which is precisely why we have developed our own measure of risk: iVaR.

Read more

Crypto portfolios beyond indexing and traditional risk measures

Building a portfolio of digital assets can be a complicated task because it’s quite new and different from traditional asset classes. But one thing is certain: approaching digital assets like traditional asset classes is a mistake. So, what’s the secret? We developed a way to intelligently build portfolios of digital assets. And we’ve put it to the test. It works in backtests and it also works in the market. Read the paper to learn more.

Read more

Diversification in an iVaR framework: How iVaR leapfrogs Markowitz’ Curse of Diversification.

In this paper, we will explore how iVaR provides a next-generation, human-centric measure of risk that captures all risk dimensions an investor might care about. Building further on Dr. Markowitz groundbreaking work, we compare iVaR to traditional variance-based portfolios and find that iVaR tends to concentrate less and leads to more natural diversification. Dr. Markowitz was a pioneer in the world of economics and finance. His contributions and influence will remain a guiding force for us.

Read more

Embracing the human perception of risk

InvestSuite’s approach to measuring risk arose from the desire to capture what people intuitively perceive as investment risk. In the end, investors all want the same thing – an account that offers the steady growth of a savings account with a very low probability of losing money, but with the returns of the stock market. We cannot guarantee this, but we can optimise for it, which is precisely why we have developed our own measure of risk: iVaR.

Read more

digital investing and reporting

Crypto portfolios beyond indexing and traditional risk measures

Building a portfolio of digital assets can be a complicated task because it’s quite new and different from traditional asset classes. But one thing is certain: approaching digital assets like traditional asset classes is a mistake. So, what’s the secret? We developed a way to intelligently build portfolios of digital assets. And we’ve put it to the test. It works in backtests and it also works in the market. Read the paper to learn more.

Read more

Diversification in an iVaR framework: How iVaR leapfrogs Markowitz’ Curse of Diversification.

In this paper, we will explore how iVaR provides a next-generation, human-centric measure of risk that captures all risk dimensions an investor might care about. Building further on Dr. Markowitz groundbreaking work, we compare iVaR to traditional variance-based portfolios and find that iVaR tends to concentrate less and leads to more natural diversification. Dr. Markowitz was a pioneer in the world of economics and finance. His contributions and influence will remain a guiding force for us.

Read more

Embracing the human perception of risk

InvestSuite’s approach to measuring risk arose from the desire to capture what people intuitively perceive as investment risk. In the end, investors all want the same thing – an account that offers the steady growth of a savings account with a very low probability of losing money, but with the returns of the stock market. We cannot guarantee this, but we can optimise for it, which is precisely why we have developed our own measure of risk: iVaR.

Read more

Thank you for your interest!

Please complete the form below and one of our experts will contact you to make further arrangements.

Looking forward to connect!