The Power of Notifications: Building Relationships for banking and Robo Advisory

Our "Robo Advice 3.0" whitepaper delves into the evolution of digital wealth management, emphasizing the need for robo-advisors to offer a more personalized and engaging experience. In it, we suggest that robo-advisors should feel less like robots and more like human advisors, interacting with users through continuous communication. One crucial yet often underexplored element in this evolution is the role of notifications, which can significantly shape user behavior and foster relationships.

Let’s dive deeper into why notifications are not just reminders but relationship builders.

Why Notifications Matter

In today's digital age, notifications have become ubiquitous, whether it's social media alerts or banking updates. Yet, many traditional financial institutions have been slow to leverage notifications effectively, unlike their digital-first counterparts such as Revolut or Robinhood. These modern fintech firms use notifications not just for transactional updates but as a way to guide and engage users in their financial journey, gently nudging them towards beneficial actions.

Transactional updates are a must. But notifications should be used for so much more.

For robo-advisors, notifications can serve multiple purposes:

- Engagement: Keeping users actively involved with their portfolios.

- Education: Providing timely insights to help users make informed decisions.

- Habit Formation: Reinforcing positive behaviors, such as regular investments.

- Relationship Building: Establishing a sense of continuity and care in the user’s financial journey.

Notifications of all kinds are good: SMS, WhatsApp, email, and push notifications all have a role to play; they can all increase the strength of relationships. Later in the article, we examine examples of push notifications, but the principles could be applied to other notifications as well. It is worth noting that push notifications have a very high open rate compared to others and can be adapted to fit many use cases. However, that topic could be an article in itself.

Notifications as Relationship Builders

Contrary to the perception that notifications are intrusive, when used thoughtfully, they can create meaningful touchpoints between a user and a digital service. This is particularly true for robo-advisors, which often lack the human element traditionally associated with high-end financial advice. But it is also true for retail banks more generally as they increasingly limit the scope of their branch network and, therefore, lose one of their historical touchpoints.

Now that banks are in our pockets, they need to leverage all of the advantages that this can bring.

Here’s how notifications can humanize the robo advisory experience:

- Personalization: A personalized notification that acknowledges the user’s goals or recent activity can feel more like advice from a trusted friend than a robotic update. For instance, "You've reached 50% of your savings goal for your first home! Consider increasing your monthly contributions to stay on track." Such messages demonstrate an understanding of the user's individual journey.

- Timeliness: Sending notifications at the right moment, such as during market volatility, can reassure users and provide guidance on what to do next. For example, a notification might read, "The market has dipped by 2% today. Remember, time in the market > timing the market." This kind of timely advice can help calm anxieties and prevent rash decisions.

Celebrating Milestones: Notifications that acknowledge achievements, such as reaching a savings milestone or completing a year of consistent investing, can foster a sense of progress and accomplishment. It adds a layer of emotional connection that traditional robo-advisors often lack.

Case Study: Successful Use of Notifications

Several fintech firms have mastered the art of using notifications to build stronger relationships with their users. Let us take the example of Revolut and contrast it with some other banking experiences.

Revolut is known for its active use of notifications. They keep users informed about everything from exchange rates to spending patterns. These notifications are not merely informative but are designed to prompt action—like notifying users about budget overspend or suggesting currency exchanges at favorable rates. This proactive approach nudges users towards smarter financial behaviors.

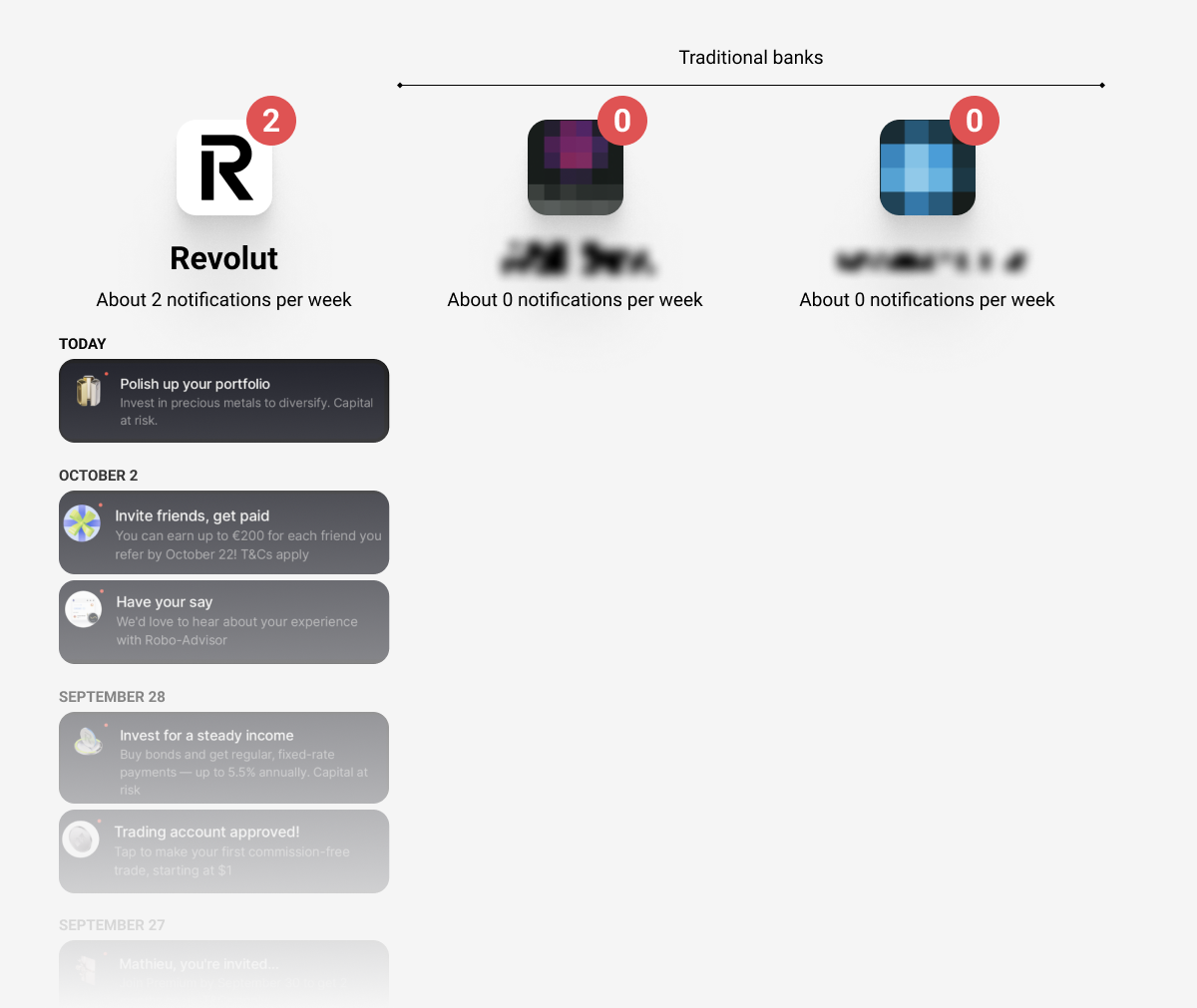

As we’re headquartered in Belgium, we decided to run a little comparison between fintechs and some of the traditional banks app that some of our team members had on their phones. We took two “traditional” banks that also offer investment solutions. As a result of what’s below, it’s no surprise that one may feel closer to a Lithuanian Bank in our pocket than to most of the local players.

Revolut Notifications vs. Our Traditional Banks Notifications

Revolut Notifications vs. Our Traditional Banks Notifications Habit Formation Through Notifications

Drawing from behavioral psychology, notifications can be a key component in building habit-forming products. Nir Eyal’s “Hooked” model outlines a process of forming habits that includes triggers, actions, rewards, and investments. Notifications serve as external triggers that prompt the user to take action, which is then reinforced by a reward (such as seeing their portfolio grow) and personal investment (spending time managing their finances). Over time, users internalize these triggers, leading to habitual engagement with the platform.

For example, a notification suggesting, "You’ve got some money leftover on your account at the end of this month!," can encourage users to regularly add to their investments. Once users see the benefit of these regular deposits, the act of contributing can become a habit, ultimately leading to better outcomes.

The Strategic Use of Nudges in Robo Advisory

Notifications are an ideal medium for delivering "nudges"—small suggestions aimed at guiding user behavior in a positive direction. This aligns well with the principles of behavioral economics, where nudges help people make better decisions without restricting their freedom of choice.

Banks and robo-advisors can use notifications to nudge users toward beneficial behaviors, such as setting up automatic monthly investments or increasing their savings rate. For example, a notification saying, "New year, new you! Investing an additional 1% of your income each month could help you retire 3 years earlier," provides a subtle but compelling push towards a beneficial action.

Avoiding Notification Fatigue

While notifications can be powerful tools, they must be used judiciously to avoid overwhelming users. Notification fatigue occurs when users receive too many alerts, causing them to tune out or even disable notifications entirely. To prevent this, financial institutions should focus on relevance, timing, and personalization. Not every market dip warrants a notification; instead, prioritize sending alerts that offer actionable insights or positive reinforcement.

Conclusion: The Path Forward for Robo Advisory

Incorporating a thoughtful notification strategy into banking and robo advisory services can transform a somewhat passive digital platform into an active participant in a user's financial journey. Notifications, when used strategically, not only keep users informed but also build trust, encourage positive financial behaviors, and foster a sense of connection. As the industry moves towards Robo Advice 3.0 and beyond, the art of crafting meaningful notifications will be essential for creating habit-forming products that engage and retain users.

By embracing the power of timely, personalized notifications, financial institutions can bridge the gap between the impersonal nature of automated services and the human touch that customers still crave. The result? A new generation of digitally empowered investors who view their robo-advisor not as a tool, but as a trusted partner in their financial future.

If you are interested in exploring how you could make digital experiences feel more human, we’d love to have a chat, so be sure to contact us or download our Robo Advisor Product Sheet!

Stay Ahead.