Capitalize on a growing trend while managing risks intelligently.

Investors are increasingly interested in digital and crypto assets and are seeking advice for navigating this new space. As new regulations make it easier to navigate for institutions, now is the perfect time to consider adding digital assets portfolios.

Offering access to this asset class intelligently is an opportunity for advisors and wealth managers to attract and retain investors who might otherwise take that part of their portfolio elsewhere.

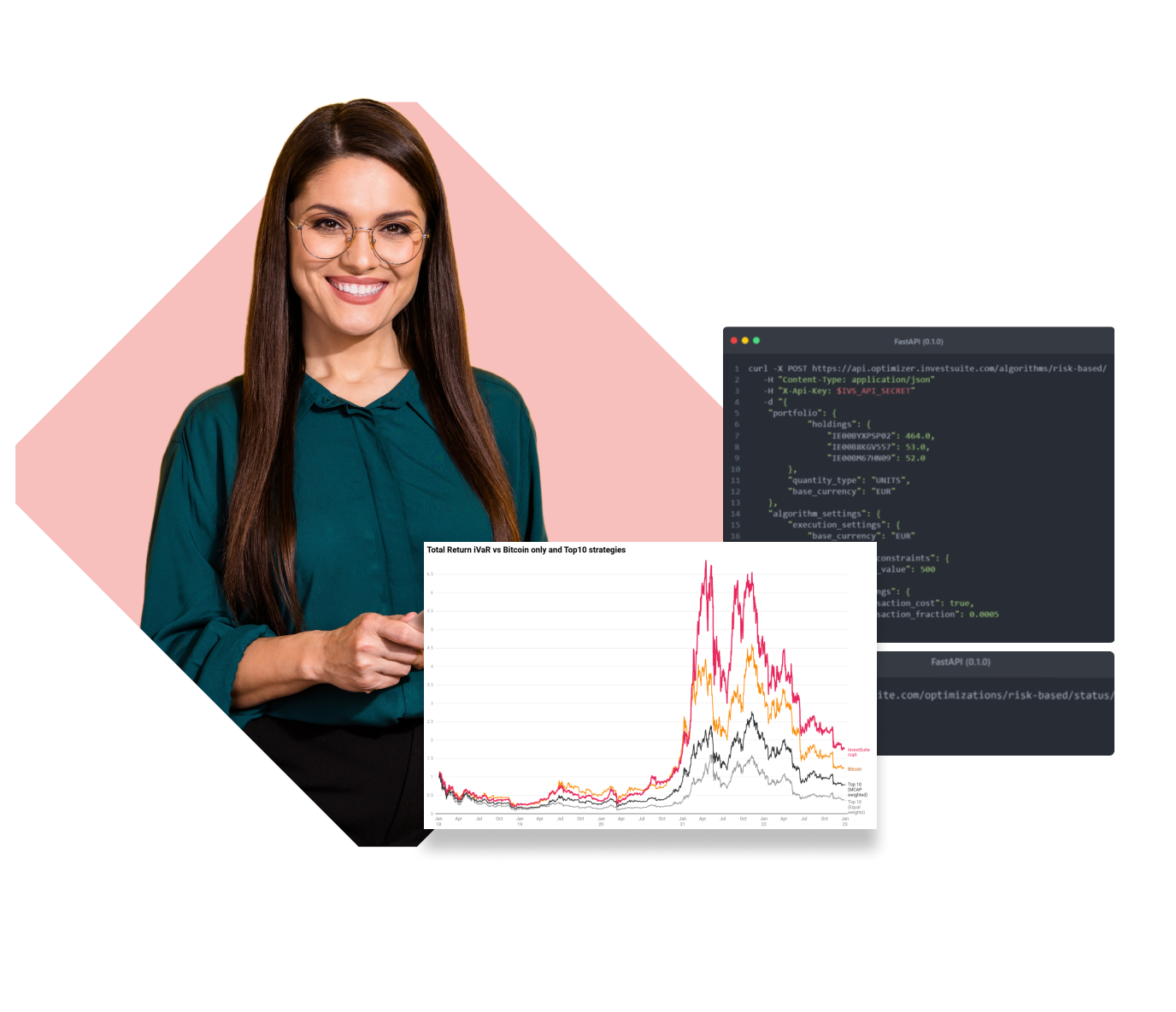

Our innovative measure of risk, iVaR, and our Portfolio Optimizer enable you to offer crypto portfolios, add crypto assets to your portfolio, or build “satellite” portfolios with nothing but crypto. Optimally. So your business grows.

Portfolio Optimizer

- Portfolio Optimizer is a cloud-based portfolio construction framework that offers iVaR, our 4th generation risk metric.

- Unlike traditional measures of risk, it doesn't assume a normal distribution of risk and is therefore much better suited to this young asset class.

- The traditional indices and “baskets” are sub-optimal allocation mechanisms as they often don’t screen for quality or liquidity, don’t allow investors to capitalise on up-and-coming narratives, and rebalance too infrequently to avoid catastrophes.

- Offer digital assets intelligently and stay ahead.