Extend your banking offer and boost profitability.

Up to now, most challenger banks have mainly been focusing on payment and financial planning solutions. While this is a great way of gathering customers, the profitability of these services is generally low.

A logical next step is for challenger banks to consider distributing investment products as a source of additional income. However, developing proprietary investment solutions is very time-consuming and expensive. Furthermore, many challenger banks lack the investment know-how to build state-of-the-art solutions themselves.

Our B2B InvestTech solutions are easy to integrate with your existing systems and are specifically targeted at less experienced retail investors. They can help you open up new revenue streams in a matter of months, instead of years.

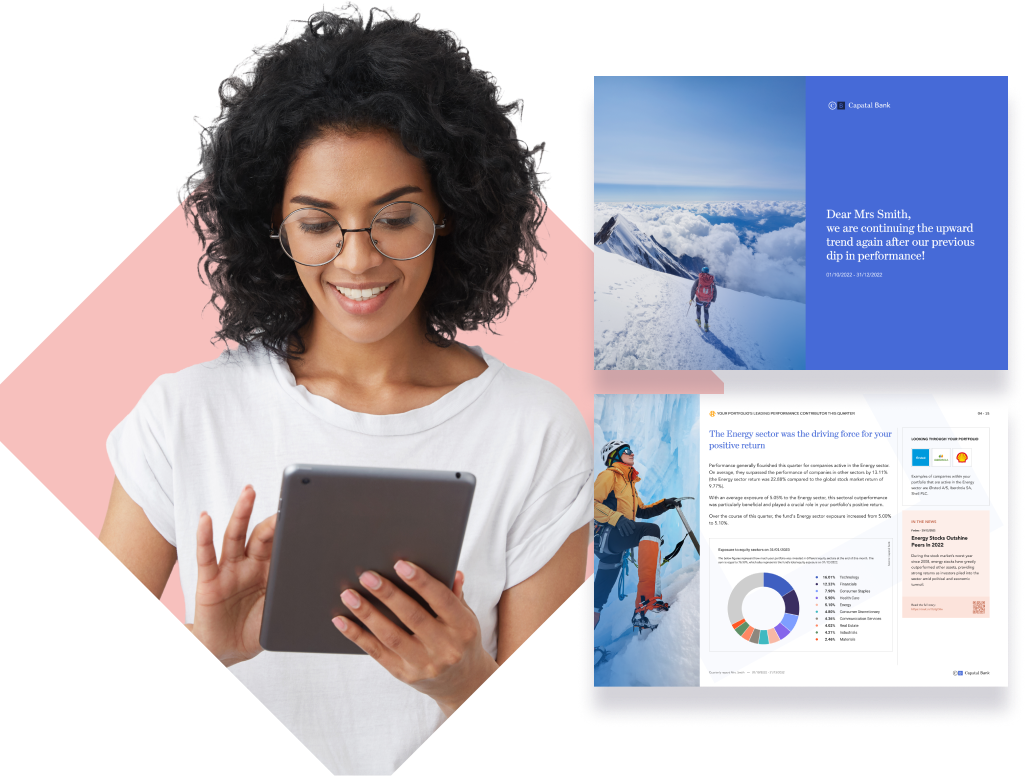

StoryTeller

Story Teller explains investment performance to end investors in a fully personalised way, using relatable, understandable language.

It analyses the drivers of investment performance and outputs the results in an intuitive, fully personalised and automatically generated report.

Robo Advisor

Robo Advisor is an automated, easy-to-use investment service.

It combines intuitive UX/UI and regulatory compliant onboarding with state-of-the-art portfolio construction, reporting and rebalancing. It is an API-based, multi-device solution, designed for seamless integration into core banking/back-end systems. The service can be used in an advisory or discretionary setting.

Self Investor

Self Investor is an intuitive and easy-to-use digital trading platform. It enables both first-time and more experienced investors to gather sufficient information and guidance to be able to manage their investment portfolio themselves.

Insight APIs

Challenger banks can enhance their customers’ investing experience by accessing, embedding and surfacing our dedicated suite of unique API-powered insights.