More accurately evaluate investment manager performance and increase client engagement.

Evaluating your investment managers is not always straightforward. Traditional investment benchmarks are often not investable, for example due to liquidity or concentration issues. Furthermore, your internal investment policy may be very specific and not have a corresponding benchmark available.

Even in today’s digital age, retail investors only have limited tools at their disposal to properly monitor the performance of their pension fund investments. Improving interaction and understanding can increase customer satisfaction and encourage retail investors to save more.

Our B2B InvestTech solutions have been designed to help pension funds turn these challenges into new opportunities.

StoryTeller

StoryTeller helps pension funds explain investment performance to their end investors in a fully personalised way, using relatable, understandable language.

It analyses the drivers of investment performance and outputs the results in an intuitive, highly personalised and automatically generated report.

Portfolio Optimizer

Portfolio Optimizer consists of a range of quantitative tools that can be used by pension funds to increase their efficiency and reduce costs.

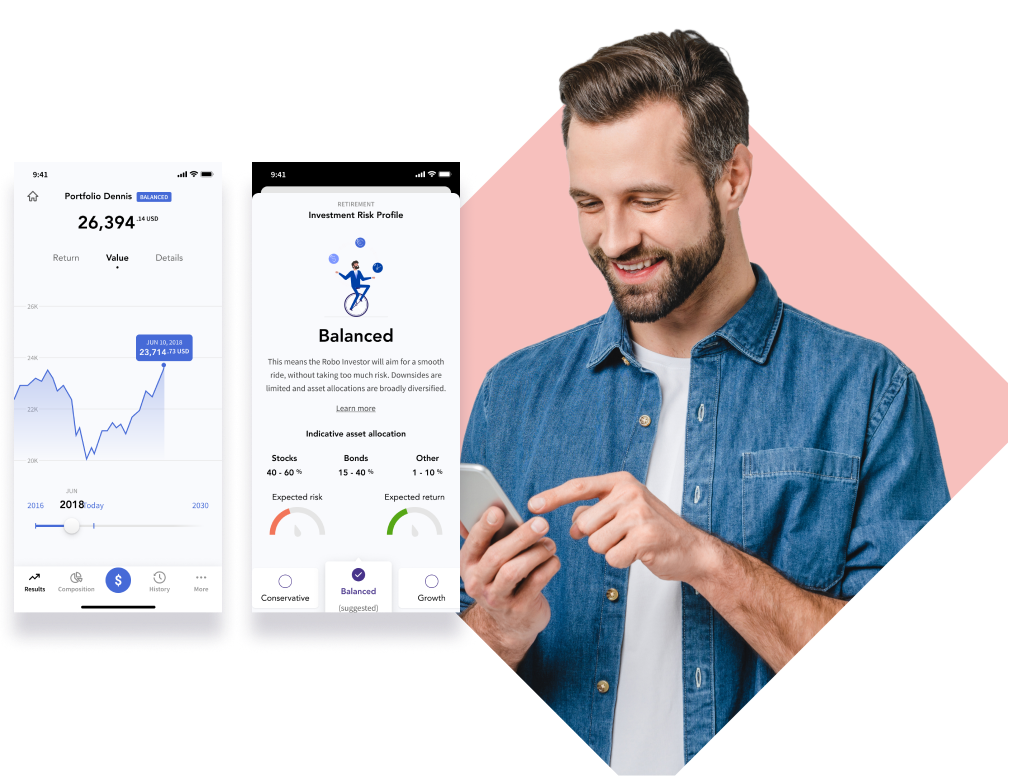

Robo Advisor

Our white-label Robo Advisor that provides goal-based investing with hyper-personalised and purposeful portfolios.