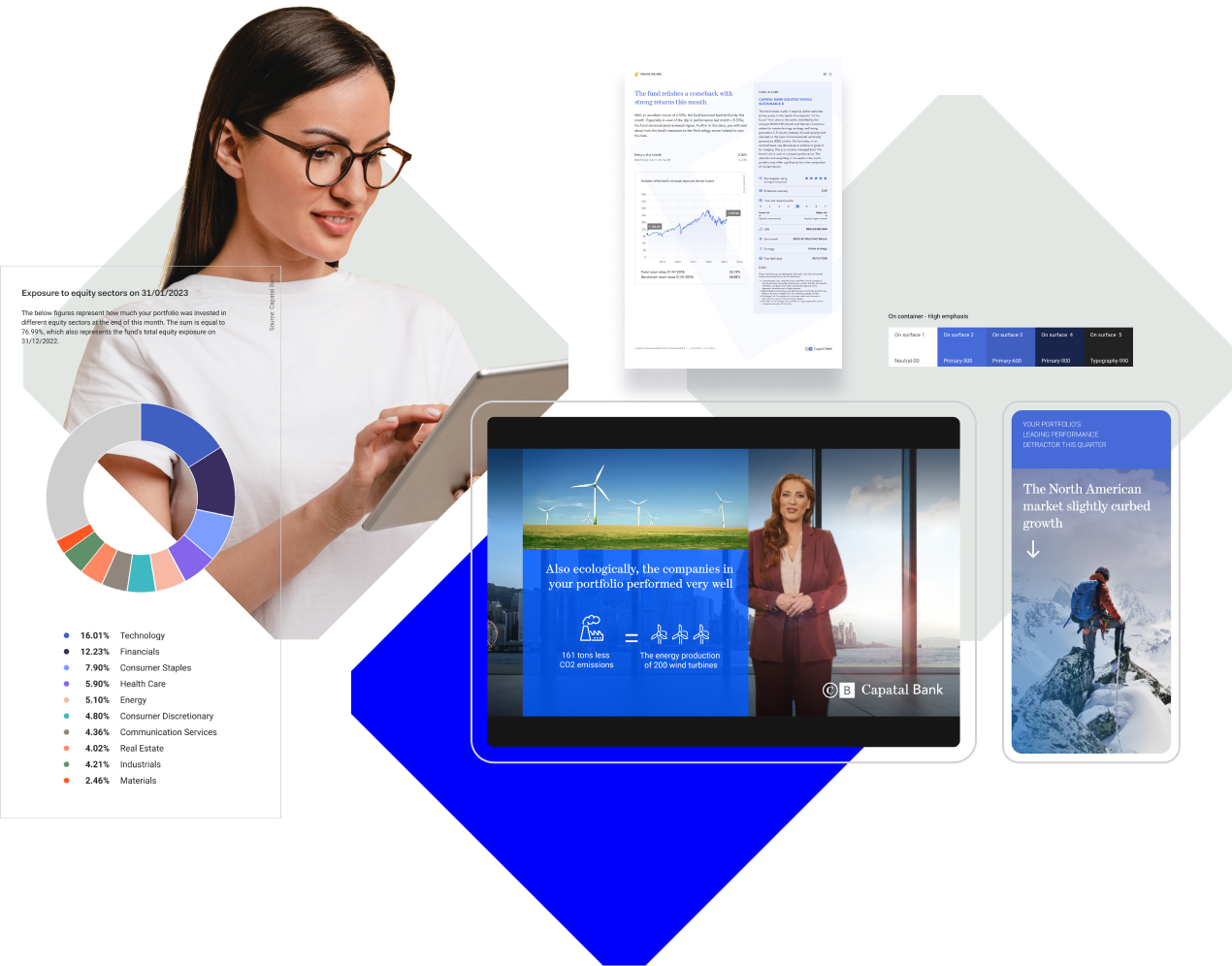

StoryTeller for Portfolio Reporting

Engage your customers with a story on the how and why of their portfolio’s financial and sustainability performance.

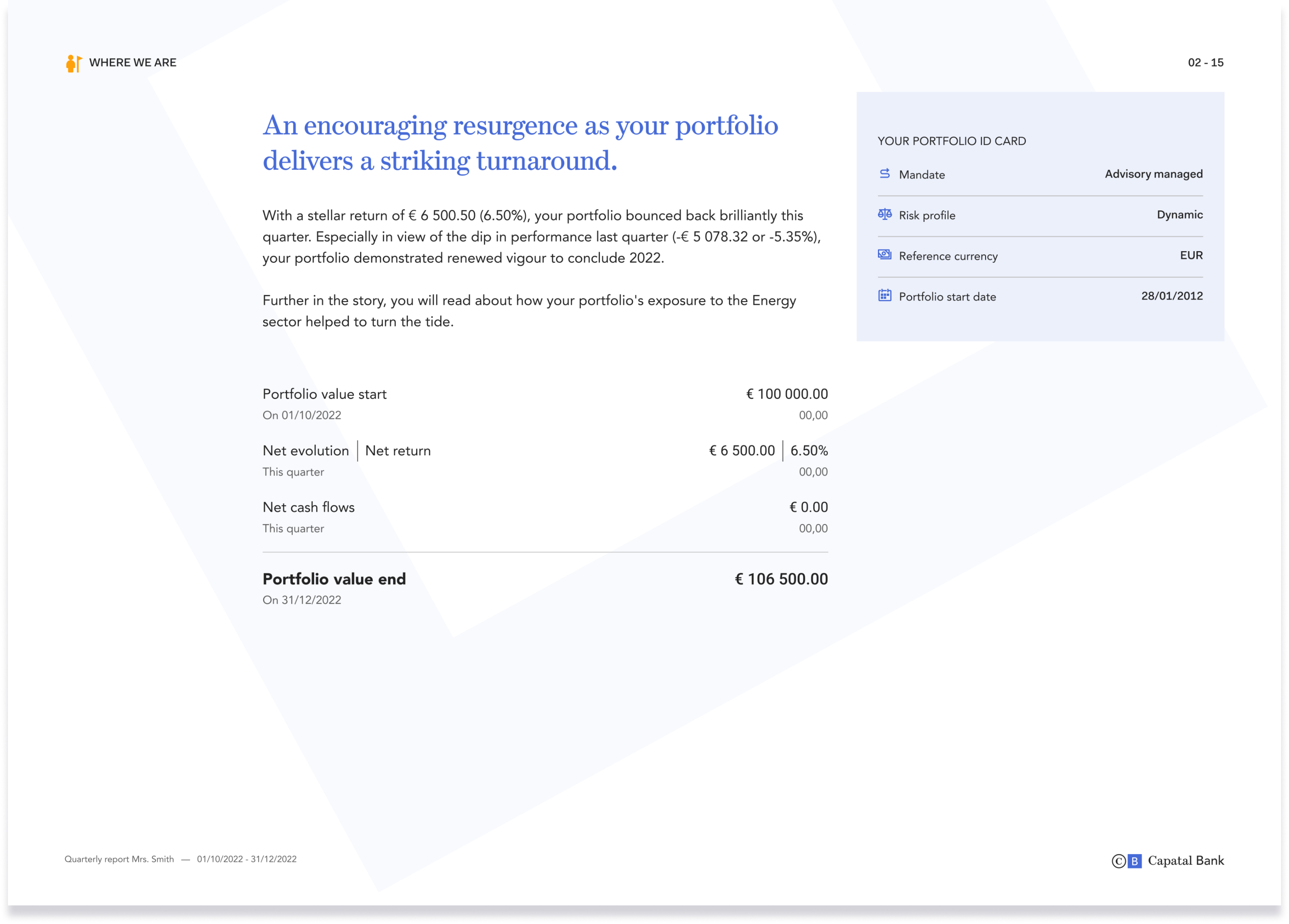

StoryTeller can calculate and explain how a portfolio evolved during a period of time and visualise any portfolio characteristics that might be of interest.

StoryTeller is underpinned by an in-house built performance attribution engine to derive insights on performance contributors and detractors.

StoryTeller has full look-through capabilities.

StoryTeller has a news retrieval engine, trained to retrieve and summarise the most relevant news article to explain the impact of a given performance factor.

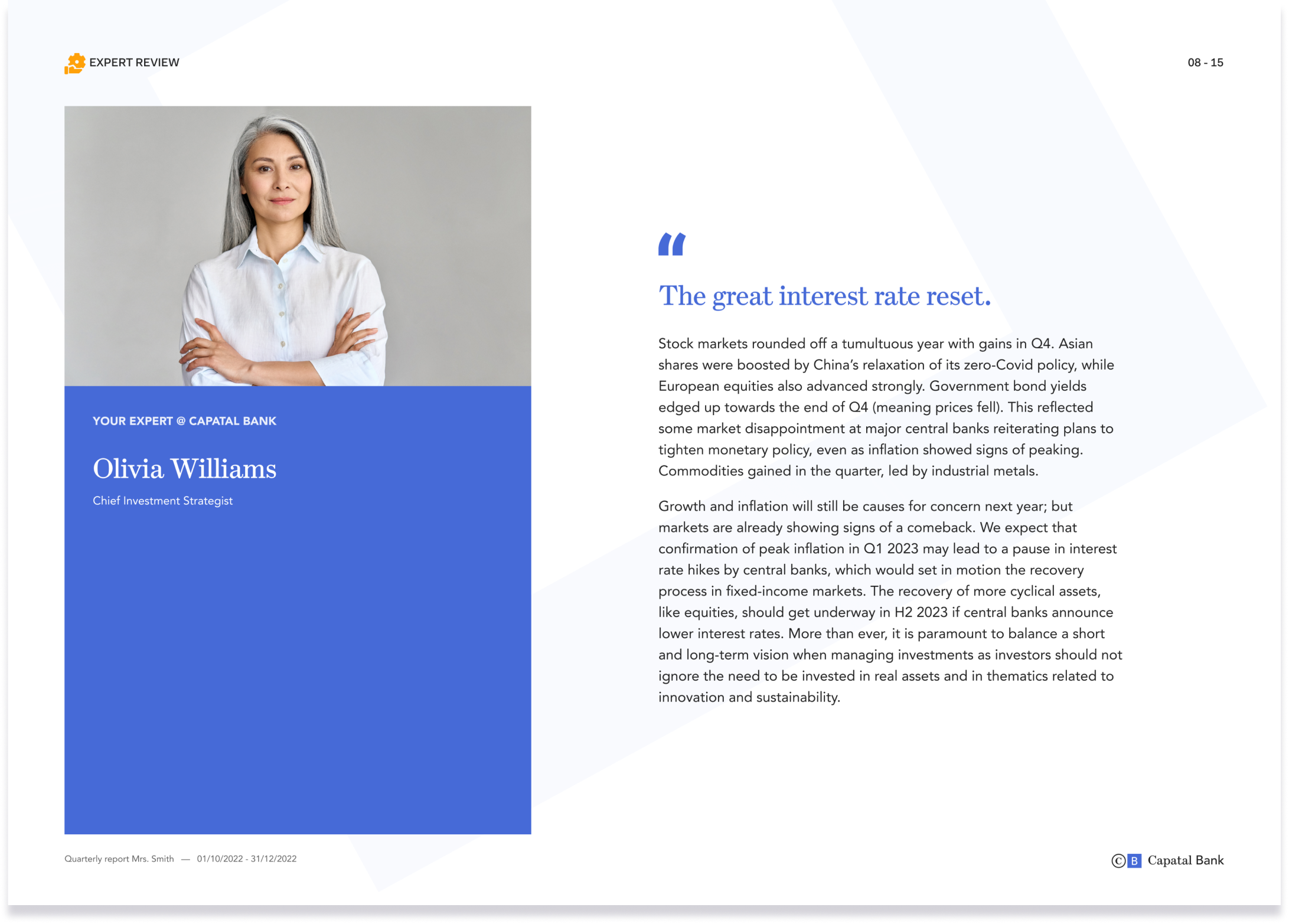

It is also possible to include specific content that is written and provided by you.

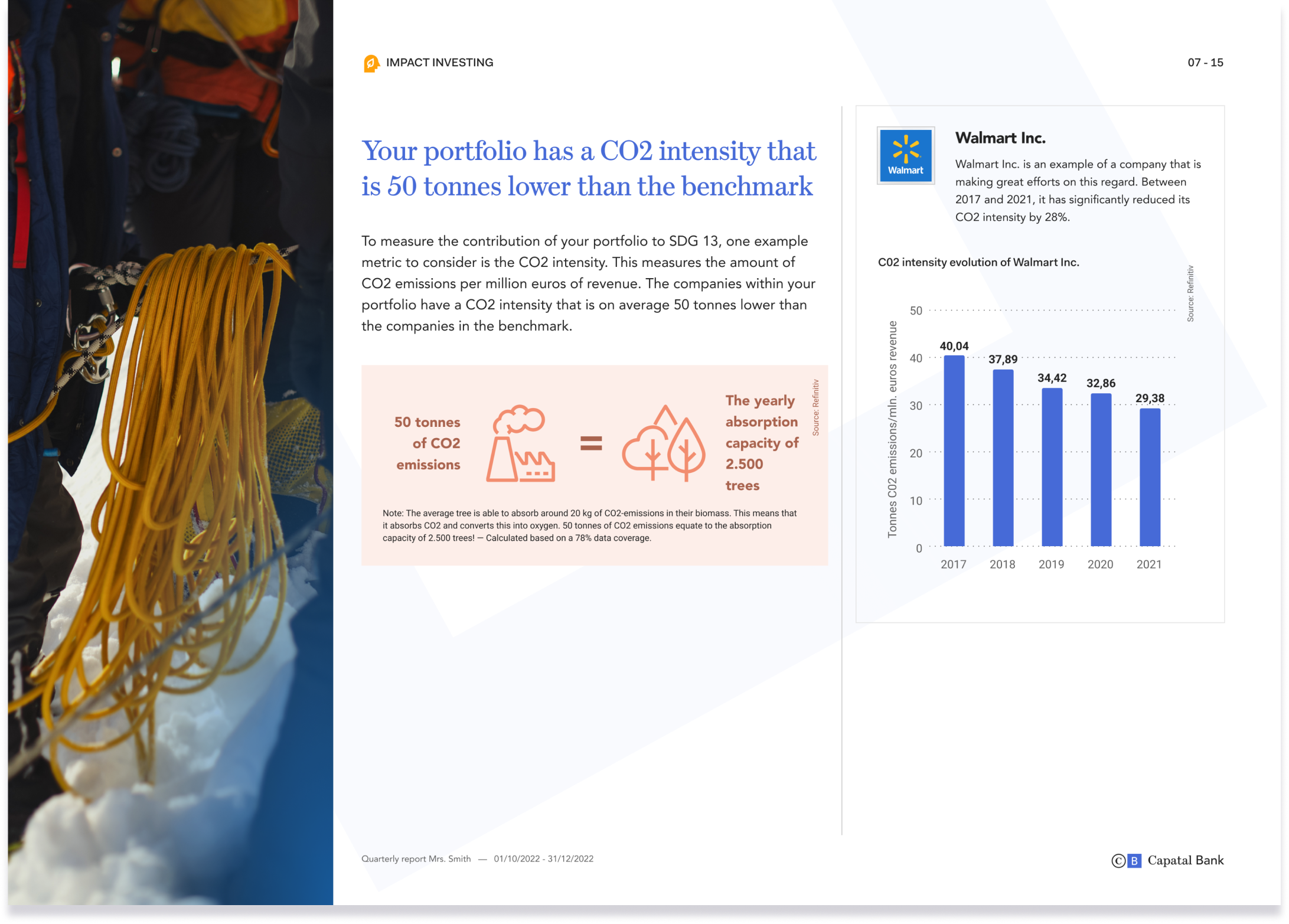

StoryTeller is able to report on exposure to investment themes and, thereby, the fund’s contribution to SDGs with relevant and tangible insights.

The contribution to SDGs can be made more tangible with a selected ESG data metric to evaluate the performance of the companies within the fund to those of the benchmark.

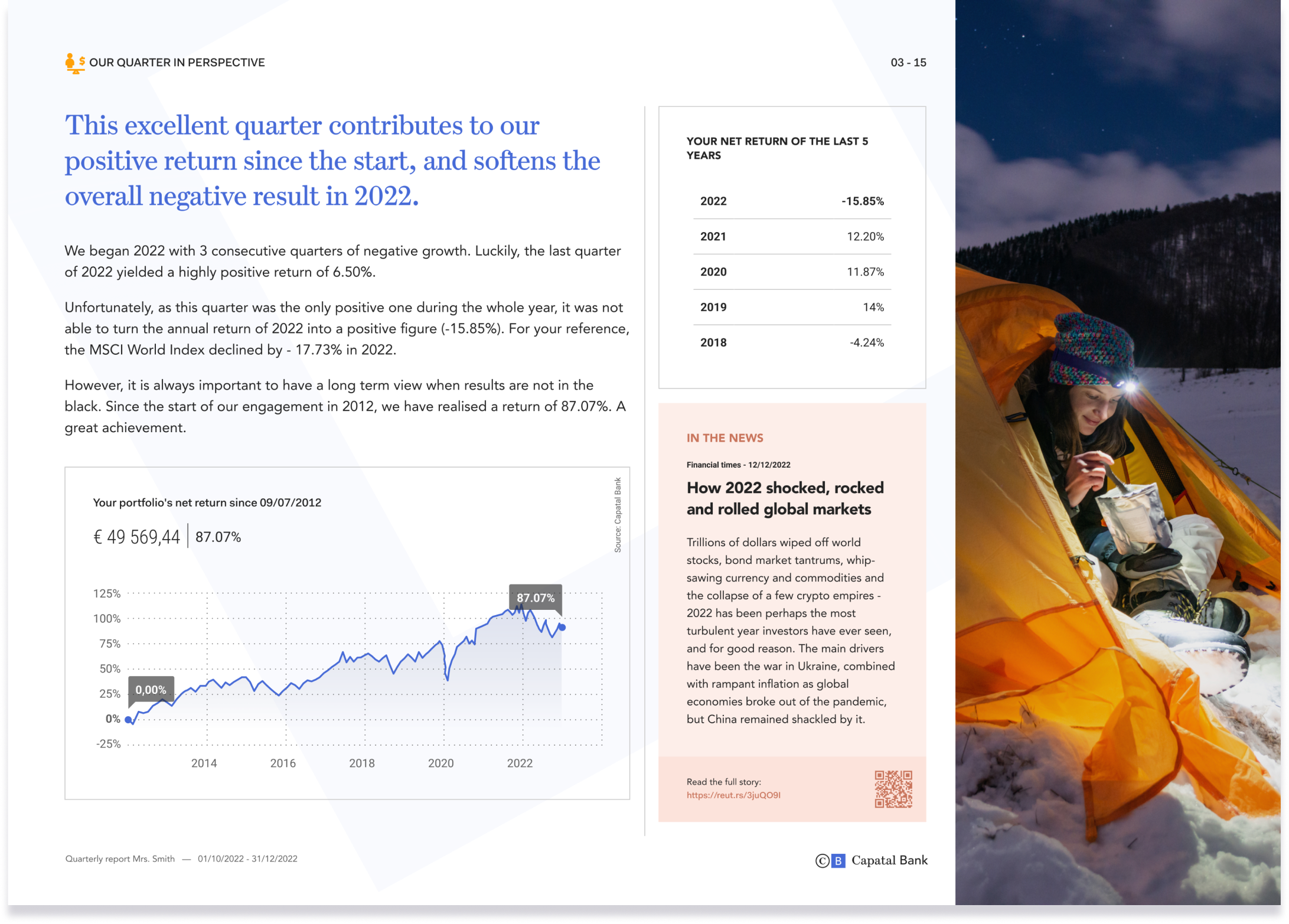

The long-term view is an important aspect of a long-lasting investment relationship. Insights on return since inception, YTD returns are crucial to put a short-term return into perspective.

A full performance attribution story can be included when a high level of detail is required.

StoryTeller reports can be generated in a print-friendly PDF, app-responsive or even video format.