Reduce client reporting and research costs and develop a new distribution channel.

Investment management teams at asset managers often have to cover a wide range of companies. Because of fee pressure and increased cost of regulation, the size of investment teams often needs to be reduced rather than increased. In this context, finding a balance between width and depth of coverage is often a challenge.

Periodical performance reporting can also be a hassle. Often it’s even hard for fund managers to understand exactly where the (out)performance of their funds is coming from, let alone for the end investor. Client reporting and client relationship management teams are often spending a lot of time creating client reports and communicating them to investors.

Finally, many asset managers are looking to distribute funds directly to retail clients, bypassing traditional distribution channels such as retail banks. This has clear advantages, not in the least the ability to retain a larger part of the fees paid by the end investor. Asset Managers however feel they lack the knowledge and experience of marketing investment products directly to retail clients in a digital way.

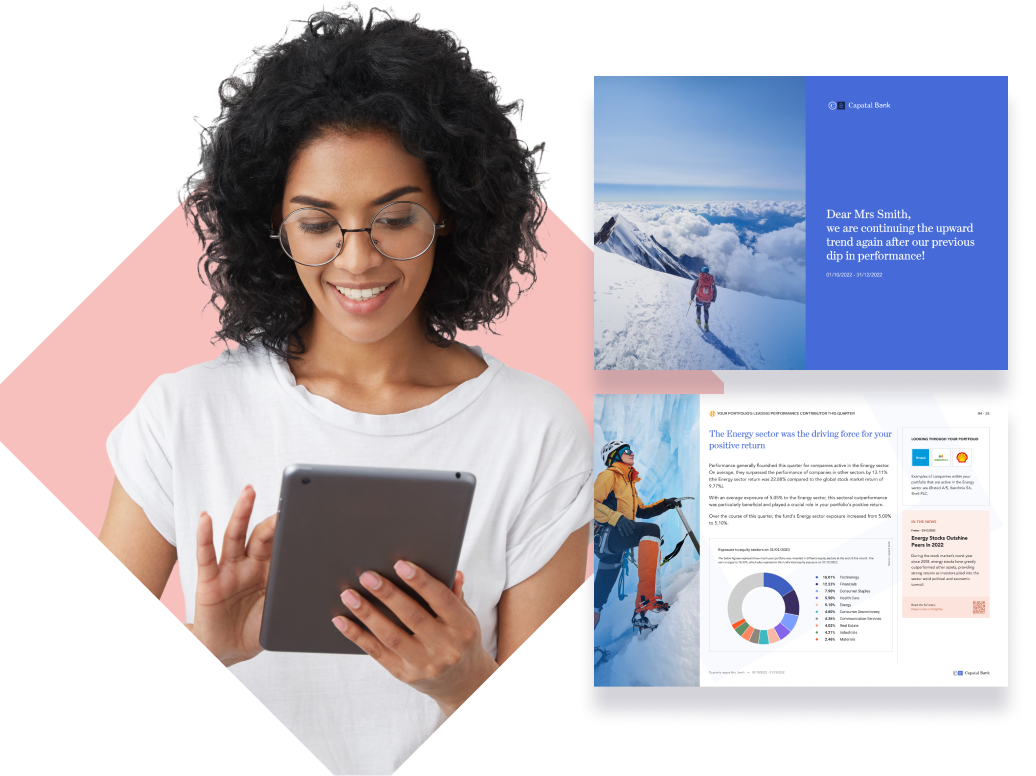

StoryTeller

StoryTeller helps investment managers explain investment performance to end investors in a fully personalised way, using relatable, understandable language.

It analyses the drivers of investment performance and outputs the results in an intuitive, highly personalised and automatically generated report.

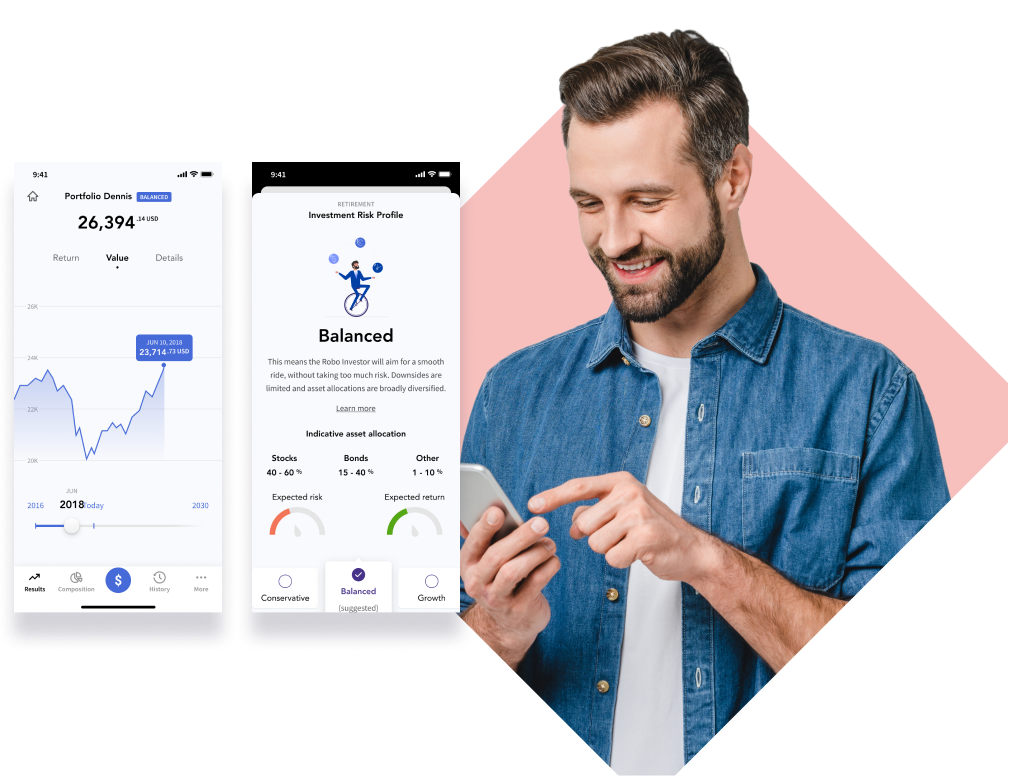

Robo Advisor

With Robo Advisor, asset managers can now offer a direct digital wealth management services to retail investors.

It provides Mifid-compliant onboarding and risk profiling, along with portfolio reporting and rebalancing. It is fully customisable at the front end and can be used with your own or third-party funds. It even provides the possibility to construct fully personalised portfolios.

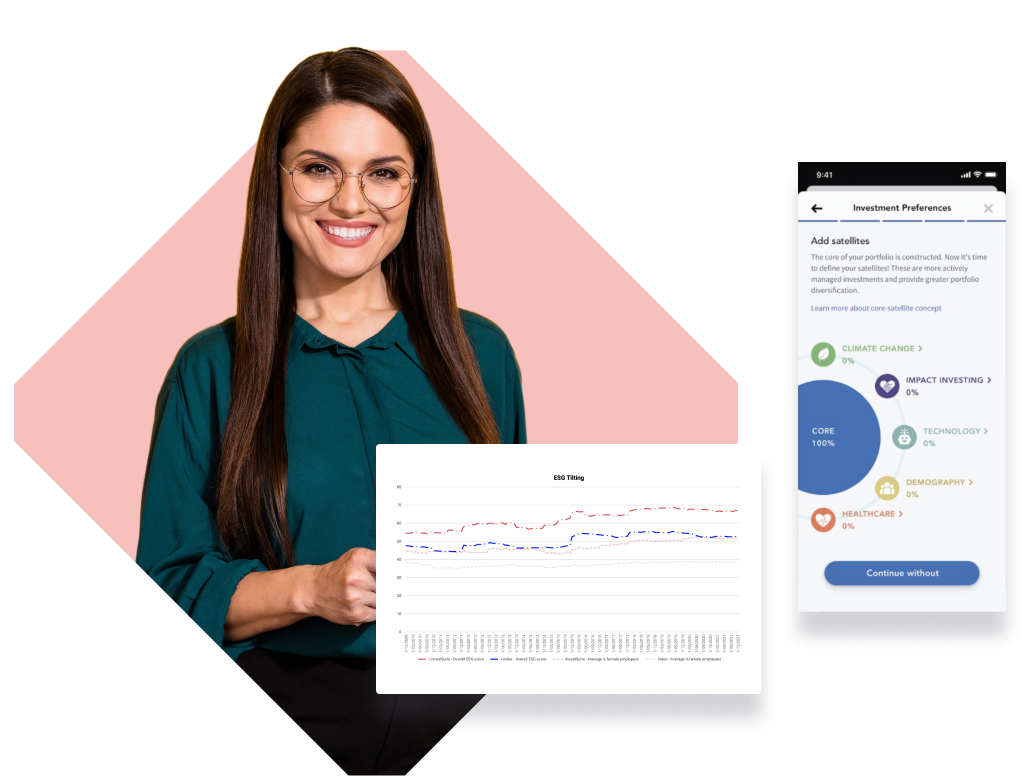

Portfolio Optimizer

Portfolio Optimizer is a cloud-based portfolio construction framework that helps portfolio managers to be more efficient, without having to add to headcount.

It is based on a quantitative methodology using a novel approach to risk. It can for example help you determine optimal security weights or can even be used to construct entire (sub)portfolios to complement core investment strategies.

Insight APIs

Enhance your customers’ investing experience by accessing, embedding and surfacing our dedicated suite of unique API-powered insights.