_ Portfolio Optimizer

A cloud-based portfolio construction framework that allows customisation at scale.

ESG Booster

Tilt portfolios towards tangible sustainability metrics.

Professional investment managers and self-directed investors often have strong beliefs about the fundamental aspects of their portfolio. However, sometimes they could use extra guidance and data to address sustainability.

Our solution

The InvestSuite ESG Booster tilts portfolios taking into account the sustainability aspects of your choice. Our state-of-the-art portfolio construction methodology ensures that the properties of your original portfolio are maintained.

- You can select multiple ESG metrics and boost them in line with your indicated level of importance.

- Our solution is data provider agnostic and can handle both high-level sustainability metrics and tangible

measures such as carbon emissions. Custom ESG data are also supported. - iVaR can be used to limit the relative downside risk versus the start portfolio.

- The investment framework provides a range of configurations to control the degree of similarity with the original portfolio.

Direct Indexing

Tailor both the index and the portfolio to the investors’ needs.

Investing in ETFs is a popular strategy to replicate the financial performance of an index. The rise of zero-commission stock trading has created an opportunity for investors to apply customised index investing strategies, i.e. direct indexing, that also reflect the investors’ preferences.

Our solution

Our direct indexing solution allows you to build fully customised benchmarks and helps investors replicate the

financial performance of the index or benchmark whilst incorporating their personal beliefs. Scalability is guaranteed via our cloud-based serverless deployment.

- Next to the traditional tracking error measure, our Optimizer can also minimise relative drawdowns compared to an index, allowing for more effective long-term index tracking.

- The configurable investment framework allows limits e.g. the number of instruments in the portfolio

or the exposures to certain sectors or fundamental factors. - Sustainability preferences are incorporated via positive and negative selection. This can involve both

high-level ESG scores and tangible measures such as carbon emissions. - Our approach makes a natural trade-off between tracking the index, optimising tax liabilities, minimising

transaction costs, and other selected investment preferences such as exclusions, ESG tilts or factor tilts.

Robo Advisory Portfolios

Hyper-personalised portfolios to meet all the investors’ preferences.

An optimal portfolio for an individual depends on their risk preferences. The constraints on the choice of the portfolio vary from individual to individual: their tax situations, ESG preferences, their time horizon, investment

preferences in certain asset classes or not and so on. There is no perfect portfolio as such, but there is a perfect portfolio for a specific individual. It is, however, a lot of work to determine that portfolio - part of the process is always to involve the investor.

Our solution

Our Portfolio Optimizer offers a range of tools to tailor portfolios to the investors’ preferences.

- Our next-generation InvestSuite Value at Risk (iVaR) metric can control the drawdowns in the portfolios, potentially giving comfort to the investor.

- The investors’ risk and ESG profile are translated into concrete investment preferences.

- Thematic investing allows clients to tilt their portfolios towards their personal preferences.

- The InvestSuite Protector Algorithm can offer explicit, individualised downside protection.

Fundamental Optimizer

The industry standard for constructing institutional and model portfolios.

Investment committees typically have clear market views, and fundamental investment teams are very skilled at selecting individual securities, but sometimes would like assistance in determining the weights in order to achieve an optimally diversified portfolio.

Our solution

Within your investment universe, our Portfolio Optimizer provides a quantitative approach to selecting security weightings.

- Our next-generation InvestSuite Value at Risk (iVaR) metric and portfolio construction methodology can help you to control the (relative) downside risk and determine weights that optimally diversify your portfolio.

- Other traditional risk measures such as volatility, Value-at-Risk, Conditional Value-at-Risk, are also supported.

- Incorporate your explicit views on individual assets or groups of assets.

- Our configurable investment framework makes it possible to control the exposure to a variety of factors.

- You can manage all sustainability aspects in your portfolios via both positive and negative selection (for example, the EU Taxonomy Regulation).

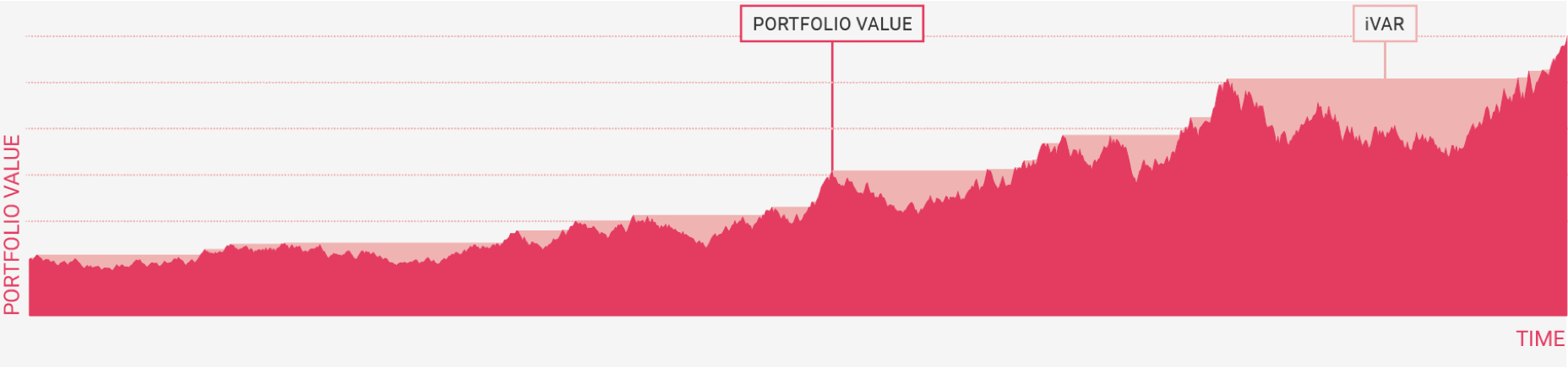

InvestSuite Value at Risk - A human-centric measure of risk

Traditional investment risk measures, such as volatility, have historically been chosen because of their simple mathematical properties. Investors typically do not perceive risk through the lens of volatility – they perceive it through depth of loss (drawdown), time to recovery and frequency of losses.

We have developed an innovative risk measure: InvestSuite Value at Risk (iVaR). Our premise is that any instrument or portfolio providing strict monotonic growth (i.e., no losses) should be riskless, regardless of the speed or consistency of the growth. This matches the behaviour of a cash savings account, which also increases monotonically in value over time, and is considered riskless by end investors. For instruments or portfolios that do not exhibit monotonic growth, we calculate the risk (“iVaR”) as the deviation from monotonic growth.

The difference between the two, the sum of the pink areas, is our measure for investment risk = iVaR. It is a combination of the size of the losses (the height of the pink areas) and the time it takes to make up for those losses (the width of the pink areas). This 4th generation human-centric measure of risk can also be used to define relative risk versus a benchmark or index, similar to how volatility can be used to define relative risk via tracking error.

Using this risk measure in portfolio construction should lead to portfolios that suffer lower losses (versus a benchmark) and make up those losses more quickly, compared to traditional risk measures.

Discover our Product Suite

Robo Advisor

A highly configurable automated investing platform that delivers hyper-personalised portfolios for goal-based investing. Discover more

StoryTeller

On-demand, hyper-personalised and narrative-based portfolio performance reporting. Discover more

Insight APIs

A suite of API-enabled solutions to guide wealth customers in their investment decisions. Discover more